Insurance

Top 5 Video KYC Solutions for Insurance Sector: A Comprehensive Guide

If you are an insurance company or agency, looking to fasten your KYC process, you are at the right place.

We've got some exciting news for you! There's a solution that's changing the insurance game, and it's called Video KYC (Know Your Customer).

In this simple guide, we'll show you the top 5 Video KYC solutions made just for the insurance world. These technologies make verifying customers easy, boost security, and provide a great user experience. No more waiting or drowning in paperwork. It's time for a smoother way to get insured.

So, if you're ready to say goodbye to the old ways and embrace the new, let's jump into the world of Video KYC for insurance.

The Rise of Video KYC Solutions in Insurance and Financial Services

The digital revolution in the insurance and financial sectors, characterized by an increased reliance on online transactions, has necessitated efficient customer verification methods.

This shift has underscored the importance of digital KYC solutions in meeting the growing demand for effective customer verification.

Video KYC (Know Your Customer) technology, particularly video KYC verification, stands at the forefront of this transformation, becoming increasingly popular across various BFSI, especially in insurance.

Growing Need for Video KYC

In the insurance sector, the digital transition has intensified the need for efficient and reliable customer verification methods.

Video KYC, adept in remote customer authentication using video conferencing technology, meets this demand effectively.

This technology is also pivotal in the context of KYC software for banks, where similar demands for quick and trustworthy customer verification are prevalent.

This method not only enhances the speed of verification but also incorporates advanced technologies like AI and biometrics, making the process more accurate and less prone to errors.

The banking sector, along with other regulated entities, has been increasingly adopting Video KYC.

The drive towards this technology is partly due to the need for regular monitoring of users for suspicious activities, which traditional KYC methods find challenging to keep pace with.

The automated nature of Video KYC offers scalability and cost-effectiveness, making it an attractive option for these institutions.

Global Adoption and Regulatory Push

The global adoption of Video KYC, driven by both trend and regulatory requirements, reflects its critical role in fraud prevention and securing financial transactions.

This technology's growing importance is also notable among KYC service providers in India, where there's a keen focus on enhancing financial security measures and regulatory compliance.

For instance, countries like Germany, Spain, and India have incorporated Video KYC into their regulatory framework, especially for financial institutions.

In the European Union, a Qualified Electronic Signature (QES) is granted only after an individual has undergone a video verification process.

The United States has also seen a rising dependency on Video KYC platforms across various industries, including fintech, healthcare, and banks, to verify customer identities and ensure compliance with regulatory standards.

This global regulatory push underscores the importance of Video KYC as a tool not just for customer convenience but also as a critical component in the global fight against financial fraud and identity theft.

Challenges Addressed by Video KYC Software

For insurance companies, Video KYC presents specific benefits like faster customer onboarding and enhanced compliance with regulatory standards:

- Faster Onboarding: Streamlines the verification process, reducing the time from application to policy activation.

This expedites customer acquisition and improves satisfaction.

- Regulatory Compliance: Adheres to KYC and AML standards, helping insurance firms meet legal requirements.

Frequent updates in Video KYC software ensure compliance with evolving regulations.

Risk Mitigation: Enhanced accuracy in identity verification minimizes fraud risks, crucial for the insurance sector's integrity and financial health.

Operational Efficiency: Automates and speeds up the verification process, leading to resource optimization and cost reduction.

Video KYC software addresses the challenges in the KYC process by streamlining and automating key aspects. It reduces operational costs significantly as it minimizes the need for physical infrastructure and manual labor. This automation leads to a much-improved user experience; customers can complete KYC procedures remotely, conveniently, and quickly, enhancing satisfaction and engagement. Additionally, Video KYC introduces robust security measures like biometric verification and AI analysis, which substantially improve fraud prevention. These features ensure accurate identity verification, crucial in mitigating identity theft and financial fraud.

Top 5 Video KYC Software for Insurance

1. Kriyam.ai

Kriyam.ai stands out as a revolutionary solution designed to redefine how investigations are conducted, particularly in the BFSI (Banking, Financial Services, and Insurance) sectors. Unlike conventional investigation software, Kriyam.ai leverages cutting-edge AI capabilities to deliver a suite of features that not only streamline operations but also provide a significant boost to data security.

This transformative platform is engineered to cater specifically to the unique needs and challenges faced by BFSI organizations. With Kriyam.ai, you can expect a seamless and efficient investigation process that not only saves time and resources but also enhances the quality of decision-making.

Kriyam.ai doesn't just stop at traditional investigative methods; it introduces innovative AI-powered approaches that optimize field investigations. Whether it's AI-enhanced data analysis, paperless operations, or real-time monitoring, this platform has it all. It's like having a trusted ally that ensures investigations are conducted with precision and efficiency.

In the BFSI sectors where data security is paramount, Kriyam.ai places a high emphasis on safeguarding sensitive information. It aligns with compliance and regulatory standards to ensure that your organization's data remains protected at all times. Kriyam.ai offers a comprehensive AI-based solution for the insurance sector, focusing on:

AI-Enhanced Investigations: Streamlines field investigations using AI, improving efficiency and accuracy.

Paperless Operations: Facilitates digital document handling, enhancing process speed and reducing environmental impact.

Real-Time Monitoring: Allows tracking of investigation progress in real-time, ensuring timely updates and intervention.

Agent Management: Efficiently manages field agents, optimizing resource allocation and task assignments.

Advanced AI Verification: Integrates AI for face and ID verification, ensuring high accuracy in customer validation.

User-Friendly Interface: Simplifies user interaction, making the system accessible and easy to use.

Customizable Reporting: Offers tailored reporting tools, catering to specific organizational needs.

Data Security: Prioritizes the protection of sensitive information, aligning with compliance and regulatory standards.

In the insurance sector, these features address critical needs like operational efficiency, accurate customer verification, and compliance adherence, while also enhancing overall user experience.

For detailed information, please visit Kriyam.ai.

2. Onfido

Onfido is a prominent Video KYC software solution known for its features, user experience, compliance, and technology, especially suited for the insurance sector:

AI and Machine Learning: Uses advanced AI algorithms for liveness detection and biometric analysis, enhancing the accuracy of identity verification.

Global Document Verification: Capable of verifying over 2,500 document types from 195 countries, ensuring broad applicability in global operations.

User Experience: Designed for a streamlined and efficient user interaction, reducing friction in the verification process.

Compliance: Adheres to stringent regulatory standards, making it suitable for industries like insurance that require rigorous KYC and AML compliance.

Security: Employs robust security measures to protect sensitive customer data.

Versatility: Suitable for a range of uses, from customer onboarding to ongoing due diligence.

In the insurance sector, Onfido's ability to provide quick, accurate identity verification helps in enhancing customer trust and meeting regulatory requirements.

3.Trulioo

Trulioo is a comprehensive KYC software solution, particularly relevant for the insurance sector. Here's an in-depth review focusing on its key aspects:

Document Verification: Supports a wide range of ID document types, facilitating diverse and inclusive customer onboarding.

Compliance: Trulioo ensures adherence to international AML and KYC regulations, a critical factor for the heavily regulated insurance industry.

User Experience: Provides a streamlined and efficient user interface, enhancing customer engagement and simplifying the verification process.

Technology Integration: Uses advanced technology for real-time verification, ensuring quick and accurate identity checks.

Business Verification: Includes features for Know Your Business (KYB), enabling insurance companies to verify business entities, which is essential for B2B transactions.

Security and Privacy: Prioritizes data security and privacy, aligning with data protection standards which are crucial for handling sensitive customer information in the insurance sector.

4. Refinitiv

Refinitiv is a comprehensive KYC and compliance software solution, particularly beneficial for the insurance sector:

KYC and AML Tools: Offers tools for both Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, critical for regulatory compliance in the insurance industry.

Human-Vetted Data: Utilizes data aggregated and analyzed by financial data analysts, ensuring high-quality and reliable information for decision-making.

Integration with Financial Databases: Access to a vast financial data catalog, assisting in deeper customer and transaction analysis.

User Experience: Designed to cater to professional financial environments, providing a sophisticated yet user-friendly interface.

Focused on Financial Services: Especially suitable for investment banking and asset management, aligning well with the complex needs of large insurance companies.

Comprehensive Compliance Suite: Includes features for sanction list screening, PEP checks, and transaction monitoring, enhancing the overall compliance posture of insurance firms.

5. SEON

SEON specializes in pre-KYC checks and fraud prevention. Its features include:

Digital Footprint Analysis: Uses online data to assess customer intentions, crucial for insurance fraud detection.

Frictionless Data Enrichment: Enhances user understanding without needing official documents, aiding in risk assessment.

Device Fingerprinting: Identifies the software and hardware configurations of users, useful for detecting fraudulent activities.

API Integration: Offers real-time results through API for seamless integration with insurance platforms.

Transparent Pricing: Includes a pay-as-you-go model, beneficial for companies of all sizes in the insurance sector.

SEON's focus on pre-KYC analytics and fraud prevention directly addresses the insurance sector's need for efficient risk management and fraud detection.

Comparison and Ranking

Comparing and ranking the top 5 Video KYC software for the insurance sector involves assessing their performance, customer reviews, and industry ratings.

Kriyam.ai stands out for its AI-enhanced investigations, making it highly suitable for the insurance sector's specific needs.

Onfido, with its AI liveness verification, is strong in identity verification and provides an excellent user experience.

Trulioo, offering global ID verification, is ideal for international operations. Refinitiv, with its focus on AML/KYC and human-vetted data, is well-suited for large insurance firms requiring complex compliance.

SEON, known for its pre-KYC checks and fraud prevention, is effective in risk management and fraud detection.

The ranking would be based on how well these features meet the unique demands of the insurance sector.

| Rank | Software | Key Features | Suitability for Insurance Sector |

|---|---|---|---|

| 1 | Kriyam.ai | AI-enhanced investigations, paperless operations | High suitability for AI-driven investigations |

| 2 | Onfido | AI liveness verification, global document checks | Strong in identity verification and user experience |

| 3 | Trulioo | Global ID verification, diverse document handling | Excellent for international operations |

| 4 | Refinitiv | AML/KYC tools, human-vetted data | Ideal for large firms needing complex compliance |

| 5 | SEON | Pre-KYC checks, fraud prevention | Good for risk management and fraud detection |

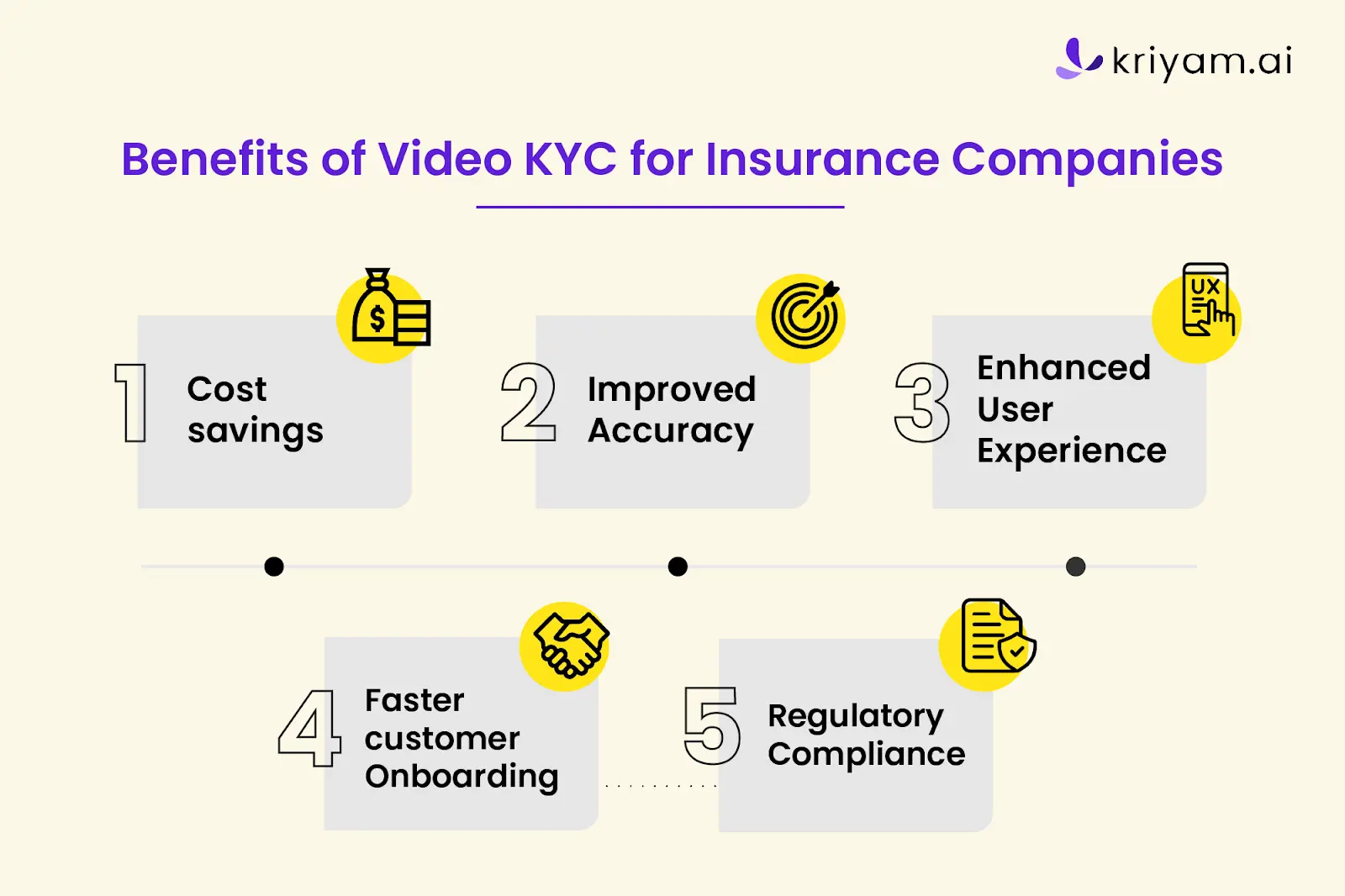

Benefits of Video KYC for Insurance Companies

Banner content: Benefits of Video KYC for Insurance Companies The benefits are:

- Cost savings

- Improved Accuracy

- Enhanced User Experience

- Faster customer Onboarding

- Regulatory Compliance

The benefits of Video KYC for insurance companies include:

- Cost Savings: Reduces operational expenses by eliminating the need for physical infrastructure and manual labor associated with traditional KYC processes.

- Improved Accuracy: Leveraging AI and biometric technology in Video KYC enhances the precision in customer identity verification, reducing the chances of errors and fraud.

- Enhanced User Experience Offers a convenient, quick, and user-friendly verification process, improving customer satisfaction and engagement.

- Faster Customer Onboarding: Streamlines the onboarding process, significantly reducing the time taken to complete the KYC process, which can accelerate policy issuance and customer acquisition.

- Regulatory Compliance: Helps in adhering to stringent KYC and AML regulations, ensuring that insurance companies stay compliant with legal requirements.

These benefits contribute to operational efficiency, customer satisfaction, and regulatory adherence, making Video KYC a valuable tool for insurance companies.

Read more - https://www.kriyam.ai/blogs/software-for-insurance-agents

Conclusion

Say goodbye to the hassles of traditional verification methods and embrace the future with open arms! Video KYC solutions are not just a change; they are a revolution in how insurance companies operate.

Here's the essence:

- Speedy Customer Onboarding: Video KYC streamlines the process, reducing wait times and making insurance accessible when you need it.-Fraud Prevention: With advanced technologies like AI and biometrics, Video KYC adds an extra layer of security, ensuring your identity is safeguarded.

- Enhanced User Experience: The convenience of remote verification makes your insurance journey hassle-free and efficient.

- Regulatory Compliance: Video KYC ensures insurance companies meet legal requirements, providing you with peace of mind.

But that's not all! The future holds even greater possibilities:

- Tailored Insurance: Video KYC's potential for personalization means insurance can be tailored to your unique needs.

- Optimized Resources: Your premiums are allocated where they matter most, ensuring your financial security.

- Fairer Rates: No more overpaying; your rates will be based on your individual circumstances.

For any queries related to Video KYC in the insurance sector, don't hesitate to reach out to Kriyam.ai. They offer a comprehensive AI-based solution with key features such as AI-enhanced investigations, paperless operations, real-time monitoring, advanced AI verification, and customizable reporting. So, get ready for a transformed insurance experience! The Video KYC revolution is here to stay, and it's time for you to embrace the future of insurance with confidence and ease. Don't wait; your insurance journey begins now!

Suvajit S

22nd January, 2024

Latest

LATEST BLOGS

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023