Video Verification (Video KYC): Digital Identity Management in 2025

Suvajit Sengupta | 12th January, 2024

3 min reads

Suvajit Sengupta | 12th January, 2024 | 3 min reads

If you're in a field like banking or telecom, you know how traditional KYC can be a headache. It's often a long process with lots of paperwork and waiting around, both for businesses and customers.

Video verification is here to change all that. It's a simple yet powerful tool that uses video calls, AI, and biometrics to verify identities remotely. This means no more long lines or piles of forms. We're talking about a quicker, smarter way to get things done.

In this blog, we will cover how Video KYC smooths out those old bumps in the verification road. We'll look at its benefits, from saving time and money to improving security. Plus, we'll share some real-life examples of video KYC software usage and how it's already making a difference.

So, if you're looking to make your verification process faster and more customer-friendly or just curious about what's new in tech, you're in the right place. Let's get started!

Understanding Video KYC: The Role of Video Verification in Modern Identity Checks

Understanding what is Video KYC process involves recognizing its role as a modern and efficient method for verifying identities in today's digital landscape.

Video KYC, short for ‘Video Know Your Customer,’ operates akin to a digital face-to-face meeting, where your identity is confirmed through a video call.

This process represents an intelligent blend of technology and personal interaction, making it a pivotal tool in the realm of digital verification.

Here's how it typically works:

Initiation: First, you start a video call, often through an app or a secure website. This is like walking into a virtual office where you're about to verify who you are.

Live Interaction: During the call, you talk to a natural person or an AI-driven system. They're there to guide you through the process, making sure everything goes smoothly.

Document Verification: You'll show your ID documents, like a passport or driver's license, to the camera. The system checks these documents in real-time to ensure they're valid and genuinely yours.

Liveness Detection: This part is pretty cool – the system verifies that you're a real, live person, not just a photo or a pre-recorded video. It might ask you to blink, smile, or nod.

Data Security: Throughout this process, your data is handled securely. The systems used for Video KYC are designed to protect your personal information and comply with privacy laws and regulations.

Completion: Once your identity is confirmed, the process is complete. It's usually much quicker than traditional methods.

Video KYC lies in its blend of technology and convenience. For businesses, it's a secure and efficient way to onboard new customers or verify existing ones without the need for physical presence.

For customers, it means they can verify their identity from anywhere without the hassle of visiting an office or dealing with paperwork.

This process, being fast and user-friendly, is becoming increasingly popular in various industries, especially in banking, finance, and telecom.

The beauty of Video KYC, a key component of the KYC verification process, lies in its simplicity and effectiveness.

Video KYC is a smart response to the need for secure, efficient, and user-friendly identity verification in our increasingly digital world.

It represents a significant leap forward from the old ways of verifying identity, making the process quicker, more secure, and much more convenient.

Also Read about Facial Recognition Technology in 2025

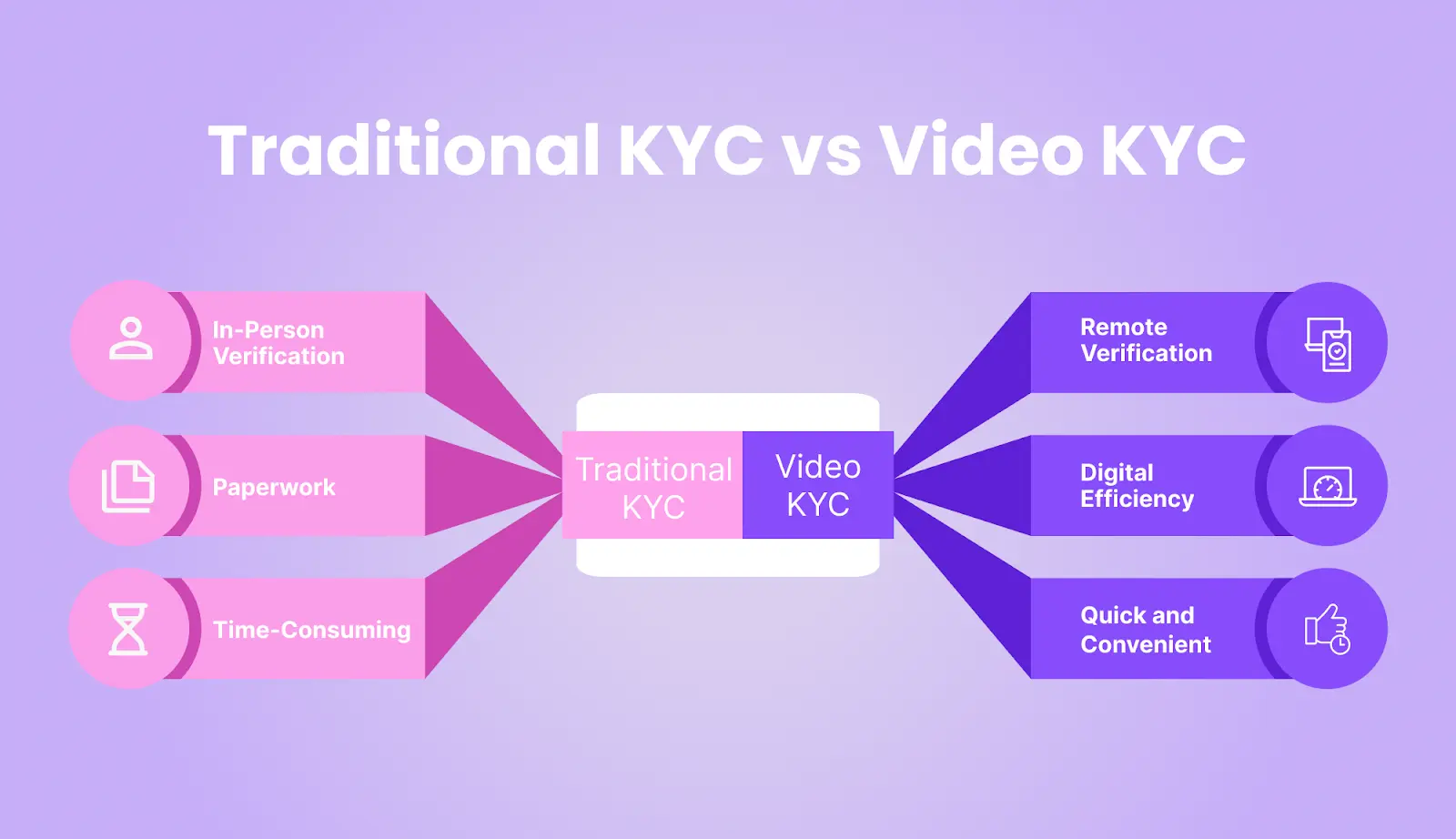

Traditional KYC vs Video KYC

In traditional KYC for a mobile phone contract, you typically visit a retailer or service provider's store with your identification documents.

The store representative verifies your identity face-to-face, fills out necessary forms, and then awaits approval, which could take several hours or days. This process requires physical presence and often involves substantial paperwork.

Video KYC streamlines the mobile phone contract process significantly. Through a secure video call, you can showcase your identification documents to a representative or an AI-based system from the comfort of your home or office.

This real-time verification eliminates the need to visit a retail store. The entire process, from identity verification to contract signing, can be completed digitally, making it faster and more convenient. This method not only saves time but also reduces the hassle of physical paperwork, offering a modern, efficient way to secure a mobile phone contract.

Both methods aim to verify identity, but Video KYC offers a faster, more user-friendly approach. Understanding the difference between Traditional KYC and Video KYC is like comparing the old way of doing things with a new, tech-savvy method.

Let's break them down in a simple way:

Traditional KYC:

In-Person Verification: Here, you physically go to an office, like a bank. You take your ID documents with you, and a staff member verifies them face-to-face.

Paperwork: There's often a lot of paperwork involved. You fill out forms, sign documents, and sometimes wait for manual processing.

Time-Consuming: This process can take days, sometimes even weeks, depending on the institution's workload and efficiency.

Example: Applying for a loan traditionally involves visiting the loan office, presenting documents like ID and income proof, and meeting with a loan officer for document review and identity verification.

After submitting the necessary paperwork, there's a waiting period for the institution to process and approve the loan application, which can take several days or weeks. This process is generally time-consuming and requires in-person visits and manual paperwork.

Video KYC:

Remote Verification: Instead of going somewhere, you do everything through a video call, usually on your phone or computer.

Digital Efficiency: You show your ID documents over the camera. The system checks them in real time using technology, making them much faster and more efficient.

Quick and Convenient: The whole process can be completed in minutes without you ever leaving your home.

Example: Imagine you want to open an online trading account. You download the app, initiate a video call, show your ID to the camera, follow some simple instructions for liveness detection (like blinking or smiling), and you're done.

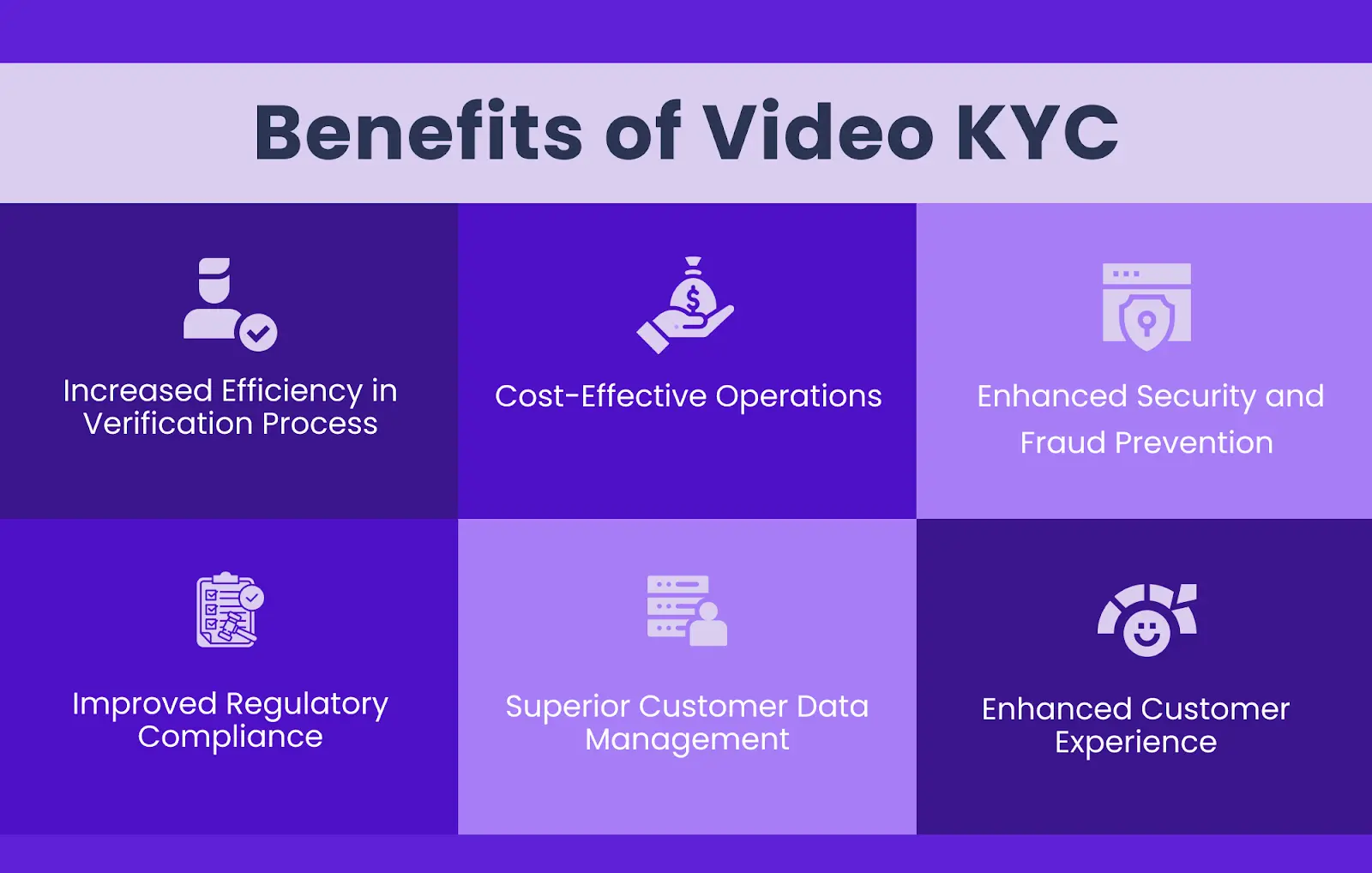

Benefits of Video KYC

Video KYC or Video Know Your Customer, brings a seamless blend of advantages to the table, redefining the traditional approach to identity verification. This modern method stands out for its ability to streamline and secure the verification process, which is essential in our increasingly digital world.

1. Increased Efficiency in Verification Process

- Video KYC automates and digitizes the verification process, allowing for real-time identity checks and document verification through video conferencing.

- This significantly speeds up the process, reducing the time from days to minutes, which is crucial for businesses that handle a high volume of verifications.

2. Cost-Effective Operations

- By eliminating the need for physical infrastructure and reducing reliance on in-person staff, Video KYC cuts down operational costs.

- This is especially beneficial for businesses looking to optimize their budget and resources, leading to potential savings that can be passed on to the customer.

3. Enhanced Security and Fraud Prevention

- Utilizing advanced technologies like biometric analysis and AI-driven checks, Video KYC provides a more secure verification method.

- This helps in significantly reducing the risks of identity theft and fraud, which are major concerns in various sectors, including finance and telecom.

4. Improved Regulatory Compliance

- Video KYC solutions are often designed in compliance with local and international regulatory standards.

- This ensures that businesses adhere to legal requirements, minimizing the risk of penalties and helping maintain a good reputation.

5. Superior Customer Data Management

- The digitization of records allows for efficient storage, organization, and retrieval of customer data.

- Effective data management is crucial for maintaining accurate records, which is essential for quality customer service and operational efficiency.

6. Enhanced Customer Experience

- Customers can complete KYC procedures remotely, saving them the inconvenience of physical travel and wait times.

- This convenience leads to a better customer experience, which is key in today's competitive market and can result in higher customer retention. Video KYC represents a significant advancement in the way businesses conduct identity verification.

Its benefits extend beyond just improved efficiency and security; they encompass cost-effectiveness, regulatory compliance, better data management, and enhanced customer experience. These advantages make Video KYC a valuable tool for any business looking to modernize and streamline its verification processes.

Video KYC in the Insurance Sector

Video KYC, or Video-based Know Your Customer, has been increasingly adopted in the insurance sector, marking a significant shift in how insurance companies onboard and service their customers. This adoption reflects the sector's drive towards digital transformation, aiming to streamline operations and enhance customer experience.

In the insurance industry, the process of customer onboarding and policy issuance traditionally involves a lot of paperwork and in-person verification, which could be time-consuming and sometimes cumbersome for both customers and insurers. Video KYC has revolutionized this process.

When a customer applies for an insurance policy, instead of physically going to an office or meeting with an agent, they can complete the entire verification process over a video call.

During this call, customers show their identification documents to a camera. The insurance company representative or an automated system on the other end verifies these documents in real time.

They might also ask the customer to perform some simple actions, like a nod or a smile, to ensure that they are a live person and not just a photograph or a video. This step is crucial for preventing identity fraud.

This digital approach has numerous benefits for the insurance sector. It significantly speeds up the verification process, allowing customers to get their policies faster.

There's less paperwork involved, which not only makes the process more efficient but also more environmentally friendly.

From the insurance company's perspective, this method is more cost-effective, as it reduces the need for physical infrastructure and manpower dedicated to customer onboarding.

Moreover, Video KYC enhances security. Using advanced technologies like artificial intelligence and facial recognition ensures that the person applying for the insurance policy is indeed who they claims to be. This level of security is especially important in the insurance industry, where the risk of fraud is high.

Another key aspect where Video KYC is beneficial in the insurance sector is in maintaining regulatory compliance. The insurance industry is highly regulated, and companies must adhere to stringent KYC norms. Video KYC provides a reliable and compliant way to verify customer identities, keeping insurance companies on the right side of regulations.

Furthermore, Video KYC opens up new opportunities for insurance companies to reach a broader customer base. Customers in remote or rural areas, who previously might have found it difficult to access insurance services due to the lack of physical offices nearby, can now easily get insurance policies through this digital process.

Video KYC streamlines the customer onboarding process in the insurance sector, reduces costs, enhances security, ensures regulatory compliance, and expands customer reach.

This digital transformation aligns with the growing customer expectation for quick, secure, and convenient services, marking a significant step forward in the insurance industry's evolution.

Read more about Future of Insurance with AI

Delve into the New Era of Digital Identity with Kriyam.ai's Video KYC in 2025

Venture into the ever-changing realm of digital identity verification with Kriyam.ai, a leader in Video KYC for the BFSI sector.

At the forefront of insurance and investigation automation, Kriyam.ai offers innovative solutions to transform your KYC processes and boost investigative efficiency. Experience the smooth integration of advanced automation with secure and efficient identity checks. Join the digital transformation with Kriyam.ai and propel your business into an era of innovation and automated sophistication. The future of BFSI is unfolding – be a part of it with Kriyam.ai.

Conclusion

As we've journeyed through the intricacies of Video KYC and its transformative role in the digital landscape of 2025, it's clear that this technology, underpinned by video verification, is not just a trend but a cornerstone in the evolving world of digital identity verification.

Video KYC, bolstered by the robustness of video verification, with its blend of convenience, security, and efficiency, stands out as a pivotal solution in addressing the challenges of online identity verification.

For businesses and customers alike, it offers a pathway to smoother, more secure transactions and interactions.

As we continue to navigate the digital age, embracing and understanding technologies like Video KYC software, with its integral component of video verification, will be crucial in fostering trust and safety in our virtual interactions.

About the author

Suvajit Sengupta

Co-founder & CTO

Suvajit Sengupta | Co-founder & CTO

A passionate technologist who thrives at the intersection of customer needs and innovation. With a track record of building adaptive product teams, he share insights on solving real-world problems with AI and scalable tech solutions.

Interests: AI products, Team Leadership, Data Strategy

Content Overview

Share

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023