Benefits of Field Service Management Software for Insurance Agencies

Suvajit Sengupta | 6th December, 2023

5 min reads

Suvajit Sengupta | 6th December, 2023 | 5 min reads

Introduction

As a business owner or agency leader in the bustling world of insurance, you're no stranger to the juggling act of client needs, policy details, and the ever-present push for efficiency.

Imagine if you could have a digital sidekick to streamline this complex dance. Enter field service management software for insurance—a tech tool reshaping the industry landscape. But what's all the buzz about?

Well, you're about to find out. This blog isn't just a rundown! It's your flashlight in the foggy world of insurance operations, showing the path to heightened productivity and client satisfaction.

We're diving into the real meat of the matter. The tangible benefits that field management software can bring to your agency. From automating the mundane to unlocking new insights, we're peeling back the layers of how this software isn't just a nice-to-have but a growth catalyst for your business.

So, let's cut through the noise and get down to business. Are you ready to see what these tools can do for you?

Let's get started!

The Challenges of Traditional Insurance Operations

Have you ever felt like your insurance agency is stuck in a time loop, repeating the same manual tasks day in and day out? You're not alone.

For all its strengths, the insurance sector often clings to the comfort of manual processes like a safety blanket. But let's pull back the curtain and see what's really going on:

Manual Madness Picture this: desks swamped with paperwork, agents buried in forms, and the incessant click-clack of calculators. It's a scene straight out of the 80s, and it's what happens when manual processes reign supreme.

Data Silos Stand Tall In many agencies, data is like that one relative we all have who doesn't play well with others. It stays in its lane, hoarded in silos, making it a Herculean task to get a 360-degree view of the customer.

Efficiency? What's That? When tasks that could take minutes take hours instead, inefficiency isn't just a buzzkill; it's a growth killer. And in a world where time is money, inefficiency is the thief you didn't know you let in.

It's a classic case of 'how we've always done it' syndrome and a tough nut to crack. But here's the thing: the digital world isn't just coming; it's here, and it's been here. While other industries are surfing the big waves of digital transformation, insurance agencies are still dipping their toes in the water, cautious of the tides of change.

But why the slow-mo? What if I told you that field management software for insurance could be the life raft your agency needs?

Field Service Management Software in the Insurance Sector

Have you ever wondered if there's a secret weapon out there that could supercharge your insurance agency's operations? Well, guess what? There is, and it's called field service management software for insurance.

But what exactly is this tech marvel, and how does it stand out from the crowd of other management systems? Let's break it down:

Think of field management software as the Swiss Army knife for insurance agents on the go. It's a specialized tool designed to:

Tackle the Tangle It cuts through the complex knot of scheduling, client management, and claims processing with the precision of a laser.

Keep Agents Connected Whether they're at the office or in the field, this software keeps your team synced up and in the know, no matter where they are.

Data at Your Fingertips Say goodbye to the days of data silos. This software brings all your data under one roof, accessible with just a few clicks.

Now, you might be thinking, "Isn't this just another agency management system?" Not quite. Here's the scoop:

Tailored for the Field While general agency management systems are like a home base, field management software is the trusty sidekick for agents out in the wild. It's built for the road, the client visit, the on-site assessment – you name it.

Real-Time Superpowers It's not just about managing; it's about doing it in real-time. Updates? Schedules? Changes? They're all live and direct, so your agents are never out of the loop.

Client-Centric This isn't just about internal operations; it's about making your clients feel like they're the center of your universe because they are. Field management software helps personalize the client experience in ways a general system just can't match.

So, why is this distinction important? Because in the insurance game, the right tools can make all the difference. And when it comes to field management software, it's not just a tool; it's the right tool for the job.

Are you curious about how this software can turn your agency's operations from "meh" to "wow"? Stick around.

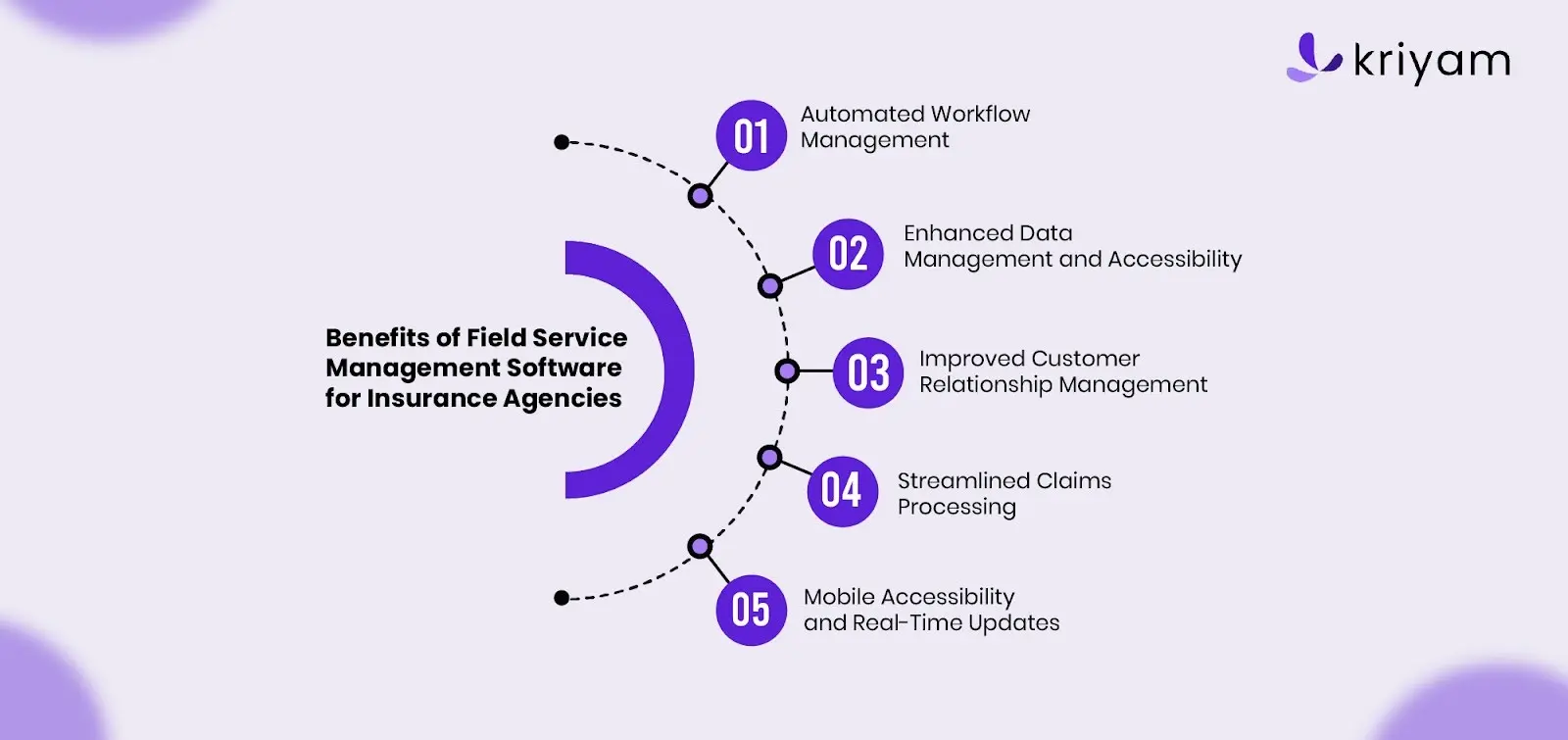

Key Benefits of Field Service Management Software for Insurance Agencies

Field management software swings into the picture, and it's a game-changer in insurance field management and investigation. Let's zoom in on the key benefits that are too good to ignore:

Automated Workflow Management

Efficiency is the New Normal: Automation transforms your agency's workflow into a streamlined powerhouse. Tasks that used to take hours, like data entry and report generation, are now completed in moments. This isn't just about saving time; it's about amplifying your team's productivity and letting them focus on what they do best – selling policies and nurturing client relationships.

Precision at Every Turn: With automated checks and balances, the accuracy of your operations hits new heights. This means fewer errors in client information, policy details, and financial transactions, leading to a more trustworthy and professional service.

Enhanced Data Management and Accessibility

Data Centralization: Imagine all your client information, policy details, and communication logs living in one unified place. Field management software does that, breaking down the barriers between data silos. This ensures that every piece of information is where it should be – at your fingertips.

A Single Source of Truth: With a centralized system, discrepancies in data are a thing of the past. Everyone from your agents to your customer service reps has access to the same, up-to-date information, ensuring consistency across all client interactions.

Improved Customer Relationship Management

Tailored Client Experiences: The software allows you to keep detailed records of client preferences, past interactions, and personalized notes. This means every call, email, or meeting can be tailored to the individual, making your clients feel valued and understood.

Boosting Client Satisfaction: Clients' satisfaction levels can skyrocket When they receive prompt, personalized service. This not only helps in retaining your current client base but also turns them into advocates for your agency, driving new business through word-of-mouth.

Streamlined Claims Processing

Accelerated Claims Handling: The claims process is often where agencies show their true colors. Field management software speeds up this process by automating the collection of necessary documents and data. Ensures tracking of claims progress and facilitates communication between all parties involved.

Consistency and Reliability: A streamlined claims process means each client receives the same level of service every time. This consistency builds trust and reliability, which is essential for a successful insurance agency.

Mobile Accessibility and Real-Time Updates

Empowerment in the Palm of Your Hand: Agents are no longer chained to their desks. With mobile access, they can pull up client records, update policies, and even process claims from anywhere, at any time. This flexibility is not just a perk; it's essential in today's fast-paced world.

The Power of Now: Real-time updates mean that the moment a client's information changes, the entire system reflects it. This ensures that decisions are made based on the latest data, keeping your agency agile and informed.

The field management software not only has the above-mentioned benefits but once tailored to your agency's needs, it's unstoppable!

If you are looking to know more about field service management, follow the link.

Comparative Analysis: Field Management Software vs. Traditional Methods

Ever caught yourself wondering if the grass is really greener on the tech-savvy side of the fence? Let's put that to the test with a good old-fashioned face-off: field management software versus traditional methods in the insurance agency arena.

It's time to roll up our sleeves and dig into the nitty-gritty of both worlds.

Traditional Methods: The Comfortable Old Shoe

Manual Mayhem: It's the way it's always been done – manual data entry, physical file storage, and a lot of legwork. Agents spend more time shuffling papers than engaging with clients.

Isolated Islands of Info: Information is scattered across different desks, files, and even departments. Getting a complete client picture? That's an expedition.

The Waiting Game: Processes are slow. Claims processing and policy updates crawl along, testing the patience of clients and staff alike.

Now, let's flip the script and see how field management software steps up to the plate:

Field Management Software: The Game-Changing Contender

Automation for the Win: Repetitive tasks? Automated. Scheduling? Optimized. The software takes the grunt work out of the equation so your team can focus on what they do best.

Data Harmony: All your data sings in harmony from one centralized system. This means better coordination, less redundancy, and no more data scavenger hunts.

Speed and Satisfaction: With streamlined processes, everything from claims to customer queries moves faster. And we all know speed makes clients happy.

Integration with Existing Systems

Alright, let's tackle the techy bit that might be giving you pause: meshing new field management software with the systems you've already got in place.

It's like introducing a new member to your well-established band. Will they hit the right notes? Let's find out.

Integration: The Harmony of Systems

The Perfect Fit: Good field management software isn't a bull in a china shop; it's more like a chameleon, adapting to fit seamlessly with the systems you already trust and rely on.

Customization is Key: Whether it's your CRM, your scheduling tools, or your customer service platforms, this software can often be tailored to ensure a snug, disruption-free fit.

Data Migration: The Careful Courier

Safe Passage for Data: The thought of moving data can send shivers down your spine, but with robust encryption and careful protocols, your information is in safe hands.

Expert Guidance: You're not alone in this. Most software providers offer expert support to navigate the migration maze, ensuring you won't get lost in the tech weeds.

But let's be real: change can be as scary as a horror movie. So, what are the common frights, and how can field management software soothe them?

Integration Anxiety: The Boogeyman in the Closet

Fear of Tech Tangles: Will new software play nice with the old? The best field management systems are built with integration in mind, coming equipped with APIs and export-import functionalities that make them team players.

Downtime Drama: Nobody wants their operations grinding to a halt. That's why many software integrations are done in stages, often after hours, to keep the show running without a hitch.

Consider the tale of Agency Alpha: clinging to their legacy systems like a security blanket, they were hesitant to adopt new software.

But with a phased integration approach, they were able to transition without missing a beat, and now they're reaping the benefits of a harmonized system.

Potential Pitfalls: The Plot Twists

The Unknown: It's the biggest bugbear. But with a clear roadmap and a dedicated support team, the unknown becomes the familiar.

Operational Hiccups: What if something goes wrong? A solid backup plan and thorough testing phase mean that even if there are hiccups, you're prepared.

So, what's the verdict? Are you ready to bring this technological symphony to your agency? With field management software, it's not about out with the old, in with the new; it's about creating a better, stronger whole.

Essential Features to Look for in Field Service Management Software

When selecting field management software, insurance agencies should look for the following essential features:

1. Policy Management: This feature allows for efficient administration and management of insurance policies. It can streamline policy issuance, renewals, cancellations, and claims management, making the process smoother for agents and clients.

2. Lead and Sales Tracking: Monitoring leads and sales is crucial to insurance business operations. The software should offer a robust tracking system that captures leads and tracks the progress of these leads through the sales funnel.

3. Agent Productivity Tools: These tools can automate routine tasks, freeing up agents to focus on critical, high-value activities. Look for software that offers features like automated reminders, calendar syncing, and document management.

4. Analytics: The software should provide a comprehensive analytics suite that can generate insights on sales performance, customer behavior, and operational efficiency. These insights can guide decision-making and strategy formulation, driving business growth and profitability.

These features are crucial for enhancing efficiency, improving customer service, and driving business growth in the insurance sector. Choosing field management software encompassing these features can ensure a robust, streamlined operation for your insurance agency.

Related Read - Top 5 Field Service Management Software in 2024

Conclusion

In conclusion, choosing field service management software is a pivotal decision for insurance agencies that can greatly affect their operational efficiency and service delivery. The size of the agency, its unique needs, budget, the scalability of the software, and the quality of customer support are all essential considerations.

Smaller agencies might require software with fundamental features, while larger firms may need more complex functionalities. It's also important to choose scalable software to accommodate business growth and provide excellent customer support.

Adopting robust field management software is a strategic investment that can significantly enhance an agency's competitiveness and efficiency, particularly in an increasingly digitalized industry landscape.

We hope this guide has shed some light on the key factors to consider when selecting the ideal system for your agency.

Looking for a tailored software for your insurance agency? Kriyam.ai is one of the best choices to consider before you decide; give it a try. Book your demo now!

Choose wisely and experience the transformation.

About the author

Suvajit Sengupta

Co-founder & CTO

Suvajit Sengupta | Co-founder & CTO

A passionate technologist who thrives at the intersection of customer needs and innovation. With a track record of building adaptive product teams, he share insights on solving real-world problems with AI and scalable tech solutions.

Interests: AI products, Team Leadership, Data Strategy

Content Overview

Share

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023