Best Tools for Optimizing Your Insurance Verification Process

Suvajit Sengupta | 2nd February, 2024

7 min reads

Suvajit Sengupta | 2nd February, 2024 | 7 min reads

Insurance verification serves as a cornerstone in insurance processes - it constructs a solid foundation for customer contentment and supports the architecture of your business revenue structure.

Much like its significance, the insurance verification process is intricate. It involves multiple steps and considerable denial rates. Moreover, the current scenario renders it impractical and costly to check clients' information manually.

Now more than ever, integrating various insurance verification tools is crucial. These tools streamline the process and boost accuracy. Also, it prioritizes security and yields cost savings.

According to a CAQH index 2022, incorporating field verification tools into the insurance scenario saves 14 minutes per consumer. So, acting swiftly and switching to integrating verification tools into your system is in your best interest.

Curious about the best insurance verification tools and how they can transform the insurance verification process? Let's explore the standout tools that are game-changers and are not to be missed.

Insurance Verification Process

The insurance verification process is the procedure of confirming a client's insurance coverage to ensure it is valid and active and to understand the terms of the coverage. This process is essential to determine whether the services or products required are covered under the client's insurance policy, including the extent of coverage, any copayments or deductibles, and any other pertinent details specific to the policy. It's like a safety check for your financial protection.

Why Accurate Insurance Verification Matters

Accurate insurance verification is very important. It helps you be sure that you are protected. When insurance companies do this check right, you can feel safe knowing your insurance is good. But if they make a mistake, it can cause big problems like delays and legal issues, which can be stressful and cause money problems.

Insurance companies use special tools to make sure they check your insurance correctly. These tools, including real-time checks, help everyone be sure about the insurance details. This helps both you and the insurance companies trust each other more.

These tools ensure accuracy, allowing both customers and institutions to move forward confidently. Let's see what these tools are.

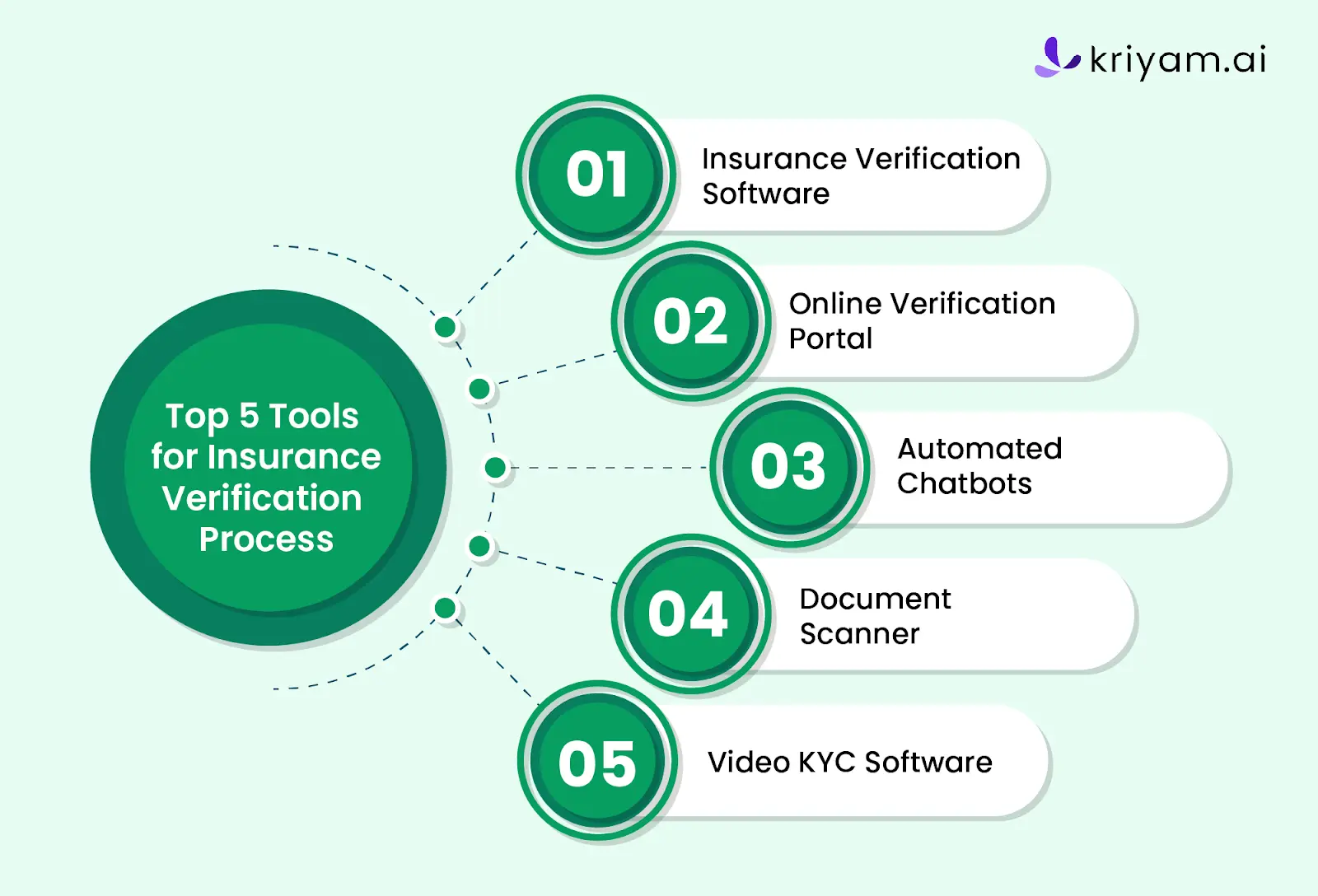

Top 5 Tools for Insurance Verification Process

In the insurance world, it's important to have tools that check insurance fast and right. Here are five top tools that make this quicker and easier:

1.Insurance Verification Software

Insurance Verification Software is a specialized tool designed to streamline and improve the accuracy of the insurance verification process. This software plays a crucial role in the insurance industry by automating and simplifying the process of confirming an individual's insurance coverage.

Here's a detailed explanation of its features and how it aids the insurance verification process:

Checks Insurance Automatically: The software quickly sees if insurance is still good, without needing a person to do it.

Gives Latest Info: It keeps the insurance info updated all the time.

Works with Other Systems: It can connect to different computer systems to share data easily.

Finds Out What's Covered: The software can tell what services or coverage the insurance policy includes.

Sends Alerts: It lets you know about important things like when the insurance will end or needs to be renewed.

Keeps Data Safe: It protects personal information and follows rules about privacy.

Easy to Use: It's made simple, so people can use it without much training.

How It Helps the Insurance Verification Process

Efficiency: By automating routine tasks, the software significantly speeds up the verification process, allowing staff to focus on more complex issues.

Accuracy: Reduces human error, ensuring that the insurance verification is accurate and reliable.

Cost-Effective: Automating the process saves time and resources, making it a cost-effective solution for insurance providers.

Improved Customer Experience: Faster verification leads to quicker service, enhancing the overall customer experience.

Example: Kriyam.ai in Insurance Verification

Kriyam.ai serves as an example of how advanced insurance verification software can aid in the process. This software uses AI and machine learning algorithms to enhance its verification capabilities. For instance, it could:

Automatically Extract Data: From submitted documents, reducing the need for manual data entry.

Intelligently Analyze Policies: Understanding complex policy structures and verifying coverage details accurately.

Provide Predictive Insights: About policy renewals or potential issues based on historical data.

2.Online Verification Portal

An Online Verification Portal is a tool used for checking insurance over the internet. Here's how it works and what it does:

Online Access: You can get to this tool on the internet, which means you can use it from anywhere at any time.

Instant Insurance Checks: The portal lets you instantly check if an insurance policy is valid.

User Accounts: People can make their own accounts to keep track of their insurance information.

Document Upload: You can upload insurance documents directly to the portal for verification.

Real-Time Updates: The portal updates insurance information in real-time, so you always see the latest details.

Secure and Private: It keeps your insurance information safe and private.

Easy to Use: The portal is designed to be simple so that anyone can use it without needing special training.

How Online Verification Portal helps in the Insurance Verification Process

Speed: It makes checking insurance faster because everything is done online.

Accessibility: Since it's online, you can use it anywhere, which is very convenient.

Accuracy: It reduces mistakes because it's automated and doesn't rely on people entering information by hand.

Example: InsureCheck Portal: An Online Verification Tool

Imagine you're an insurance customer and want to check if your policy is still good. Instead of calling the insurance company or visiting an office, you log into the online portal. There, you quickly find your policy and see that it's up to date. This saves you time and gives you peace of mind, knowing your insurance is okay. Here's how it work:

Login Feature: Users, like insurance customers or agents, log in with their unique IDs.

Dashboard: Once logged in, there's a dashboard showing their insurance policies, status, and other important details.

Document Upload: Users can upload documents like insurance applications or claim forms directly into the portal.

Instant Verification: The portal checks the validity of an insurance policy in real-time. For example, a user uploads their policy document, and the portal quickly confirms if it's active or expired.

Update Personal Information: Users can update their personal information like address or contact details.

Secure Access: The portal is protected with security measures like encryption to keep the insurance data safe.

Help and Support: There's a section for help and customer support in case users have questions or issues.

3.Automated Chatbots

Automated Chatbots are computer programs that can talk to people and help them with insurance verification. Here's what they do and how they help:

Talks Like a Human: These chatbots can chat with you almost like a real person would.

Available 24/7: They work all the time, so you can get help whenever you need it.

Answers Questions Quickly: If you have questions about your insurance, the chatbot can give fast answers.

Guides Through Processes: The chatbot can lead you through steps like checking your insurance status or updating your information.

Handles Many People at Once: It can talk to lots of people at the same time, which is really efficient.

Keeps Information Safe: The chatbot is designed to protect your private information.

Example: InsureBot: An Automated Insurance Chatbot

Here's a look at how it works:

User Interaction: When you visit the insurance company's website, InsureBot pops up with a greeting, asking how it can assist you.

Answering Queries: You can type in questions like, "Is my insurance policy up to date?" InsureBot then asks for your policy number and provides the information you need.

Guiding Through Processes: If you want to file a claim, InsureBot can guide you through the steps, telling you what information and documents you need to submit.

Instant Responses: It responds immediately, so you don't have to wait for answers.

Multi-Language Support: InsureBot can interact in several languages, making it useful for a wide range of customers.

Data Security: It ensures that any information you share is kept secure and confidential.

How InsureBot Helps

Quick Assistance: It provides immediate help, saving you the time of calling customer service.

Accessible Anytime: You can use InsureBot any time of the day, even outside normal business hours.

Efficient Customer Service: It handles basic questions, freeing up human customer service agents to deal with more complex issues.

4.Document Scanner

A Document Scanner tool is a program that lets you turn paper documents into digital files. Here's what it does and how it helps with insurance verification:

Scans Papers: It takes pictures of documents like insurance forms and turns them into digital files.

Reads Text: The tool can read the text on these documents, a process called Optical Character Recognition (OCR).

Saves Files: It saves these digital files in a way that you can easily find and use them later.

Quick Sharing: You can quickly send these digital files to insurance companies or other places that need them.

Reduces Physical Storage: Since documents are digital, you don't need as much space to store paper files.

How Document Scanner helps in the Insurance Verification Process

Speeds Up Verification: Digital files are quicker to check than paper ones.

Improves Accuracy: Reading text with OCR reduces mistakes that can happen when typing information manually.

Easy Access to Documents: Digital files are easier to find and use than paper ones.

Example: ScanRight: A Document Scanner for Insurance

Here's a brief overview of how it functions:

Easy Document Scanning: When you have a paper insurance document, like a policy or claim form, you can use ScanRight to take a clear digital picture of it.

Optical Character Recognition (OCR): ScanRight uses OCR to read and understand the text on your document. It can recognize policy numbers, names, dates, and other important information.

Converts to Digital Format: The tool turns your paper documents into digital files, like PDFs, that you can easily store on your computer or in the cloud.

File Organization: ScanRight helps you organize these digital files, so you can find them quickly when you need them.

Secure Storage: It ensures that your digital documents are stored securely, protecting your sensitive information.

How ScanRight Helps

Quick Processing: It speeds up the process of sending and verifying documents with insurance companies.

Reduces Paper Clutter: You don't need to keep as many physical documents since everything is stored digitally.

Accessibility: Digital files are easier to share and access, making the verification process more efficient.

5. Video KYC Software

Video KYC Software is a tool that uses video to confirm who you are for insurance. The Video KYC softwares speeds up KYC with a special focus on security and customer satisfaction. Here's how it works and its features:

Video Calls: You can talk to someone from the insurance company through a video call.

Identity Checks: During the call, they check your identity by asking you to show your ID, like a driver's license.

Secure Recording: The call is recorded safely to keep a record.

Easy to Use: You can use this software on your phone or computer.

Quick Verification: This process verifies your identity quickly without needing to meet in person.

How Video KYC Software helps in the Insurance Verification Process

Saves Time: It's faster than going to an office for identity verification.

Convenient: You can do it from home or anywhere with the internet.

Safe and Accurate: It's a secure way to make sure the insurance information is correct.

Enhanced Fraud Prevention: Cutting-edge technologies like facial recognition and document verification can improve the efficiency of customer verification.

Example: Kriyam.ai: An AI-Powered Video KYC Software

At the core of Kriyam.ai lies a sophisticated fusion of cutting-edge artificial intelligence. AI elevates the software to an outstanding platform delivering optimal efficiency and accuracy. Kriyam.ai safeguards customer data and information with the highest level of diligence.

Here's a brief overview of how it functions:

Robust Data Encryption: Through the integration of cutting-edge encryption technologies, kriyam.ai goes an extra mile to secure consumer data, eliminating unauthorized access.

Industry Standards Compliance: This tool is meticulously crafted to meet industry-specific standards. It proactively stays updated with the latest legal requirements to meet all vital compliance criteria.

Safeguarded Cloud Storage: With a commitment to data security, kriyam.ai offers a secure environment to save customer data.

Consistent Monitoring for Enhanced Security: With regular security audits, kriyam.ai mitigates potential vulnerabilities in the system.

Key Challenges in Insurance Verification

Let's discuss the key challenges in insurance verification along with their solutions:

1. Data Accuracy: Ensuring that all information in the insurance verification process is correct is vital. Mistakes in data entry or relying on outdated information can result in errors during verification. This can lead to issues like denied claims or coverage misunderstandings.

Solution with Insurance Verification Software: Implementing Insurance Verification Software can significantly reduce these errors. This software automates data verification, cross-checking information against up-to-date databases, and minimizes human error by reducing manual data entry.

2. Time-Consuming Processes: Manual methods of verifying insurance can be slow and inefficient, leading to delays in services. This not only affects customer satisfaction but also impacts the operational efficiency of the insurance providers.

Solution with Automated Chatbots and Online Verification Portals: By integrating Automated Chatbots and Online Verification Portals, insurance companies can streamline the verification process. Chatbots can quickly handle basic queries and guide customers through the verification process, while online portals allow for instant, user-driven verification, speeding up the entire process.

3. High Volume of Documents: Insurance companies often deal with a large volume of documents, which can be overwhelming and challenging to manage effectively. This challenge includes keeping track of numerous policies, claims, and customer records.

Solution with Document Scanner Tools: Utilizing Document Scanner tools can simplify document management. These tools digitize physical documents, making them easier to store, access, and organize. By converting paper documents into digital formats, insurance companies can more efficiently handle and process large volumes of paperwork.

4. Complex Policies: Insurance policies can be intricate, with various clauses, terms, and conditions that require careful scrutiny. Understanding and verifying these complexities is essential but can be challenging.

Solution with Video KYC Software: Video KYC (Know Your Customer) Software provides an interactive way to verify and discuss complex policy details. Through video calls, agents can directly communicate with customers, clarify policy specifics, and verify necessary information, ensuring a thorough understanding of complex policies.

5. Regulatory Compliance: The insurance industry is subject to ever-changing regulations, and maintaining compliance is a constant challenge. Staying up-to-date with these changes and ensuring that all processes are compliant is crucial to avoid legal issues.

Solution with Insurance Verification Software: This software can be regularly updated to align with the latest regulatory changes. It helps ensure that the verification process remains compliant with current laws and regulations, thereby reducing the risk of non-compliance and associated penalties.

The Future of Insurance Verification: Trends and Innovations

The world of insurance verification is evolving, and it's essential to keep an eye on the emerging trends and technologies shaping its future.

Emerging Trends in Insurance Verification

1.Blockchain Verification: Blockchain technology is making waves in insurance. It creates a secure and transparent way to verify insurance coverage instantly.

2. Digital Verification: The shift towards digital processes allows faster and more convenient verification, reducing paperwork.

3. Data Analytics: Advanced data analytics tools are being used to analyze vast amounts of data, helping identify trends and anomalies in insurance verification.

4. Mobile Verification Apps: Mobile apps are becoming increasingly popular for on-the-go insurance verification, putting the process right in customers' hands.

The Role of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of automating the insurance verification process:

1. Faster Verification: AI-powered algorithms can process and verify insurance information in seconds, significantly speeding up the process.

2. Fraud Detection: AI can detect fraudulent claims and insurance documents by analyzing patterns and anomalies.

3. Predictive Analytics: Machine learning can predict potential verification issues and proactively address them, reducing errors.

4. Personalization: AI can customize the verification process for individual customers, enhancing their experience.

As we look ahead, AI and machine learning will continue to play a significant role in making insurance verification more efficient and accurate. These innovations are set to simplify the process and improve customer satisfaction, ensuring a bright future for insurance verification.

Conclusion

The once intricate insurance verification process becomes highly simplified through technology integration. A boon to the insurance sector, these tools enhance accuracy, alleviate administrative burdens, and fortify data security.

The future of insurance verification unfolds a tapestry of advancements, incorporating diverse technologies to the horizon. Embracing these evolving trends is not just a transient phase. It is a profound revolution within the industry underpinned by dependable possibilities for the future.

If competitors have surged ahead, they have likely harnessed technology for swift processes. To bridge the gap, propel your processes forward by integrating cutting-edge insurance verification tools like Kriyam.ai into your system.

Ready to Transform Your Insurance Verification? Reach Out to Kriyam.ai

Kriyam.ai's field verification software stands out as a cutting-edge solution in the world of insurance investigations, thanks to its integration of advanced AI technology. This software is designed to revolutionize field investigations by enhancing transparency, ensuring security, and providing real-time updates.

Kriyam.ai also emerges as an ideal companion for enhancing the insurance verification process boasting advanced features that elevate the standard. Introducing this tool to your workforce not only enhances overall efficiency but also significantly reduces processing time.

Here's a detailed look at what Kriyam.ai offers and how it transforms field investigations:

What Kriyam.ai Offers

Better Turnaround Time (TAT): The software speeds up the entire field investigation process, leading to quicker case resolutions.

Dynamic Workflow: It adapts to different cases and requirements, offering a flexible workflow that can handle a variety of investigation scenarios.

Data Security: Kriyam.ai prioritizes the protection of sensitive data, ensuring that all information is secure and confidential.

Custom Alerts and Notifications: Users receive tailored alerts and notifications, keeping them updated on the progress and any critical developments in their cases.

Real-Time Tracking: This feature allows for the monitoring of investigations as they happen, providing up-to-the-minute updates.

Custom Report Generation: The software can generate personalized reports to meet specific needs, providing detailed insights into each investigation.

Automated Case Summary: Kriyam.ai automatically compiles summaries of cases, streamlining the documentation process.

Works in Low Network Areas: Even in areas with poor connectivity, Kriyam.ai's software remains functional, ensuring continuous operation.

How Kriyam.ai Helps You Perform Better Field Investigation

For Enterprises

Streamlined Workflow: The software offers a comprehensive case management system that simplifies adding and assigning cases to multiple vendors. This automated process ensures a smooth journey from case initiation to closure, including the tracking of any delays.

Efficient Case Management: Enterprises can manage their cases more effectively, with features that allow for easy tracking and resolution.

For Agencies

Efficient Case Assignment: Assign cases to specific field executives seamlessly, enhancing operational efficiency.

Delay Mapping and Resolution: The software’s ability to map delays helps in identifying and addressing issues promptly, ensuring timely case resolution.

Enhanced Collaboration: Agencies can share detailed summaries with insurance companies easily, fostering better communication and collaboration.

Kriyam.ai's field verification software is a game-changer for field investigations in the insurance sector. Its combination of AI-driven efficiency, security, and real-time capabilities makes it an invaluable tool for enterprises and agencies alike, ensuring that field investigations are more transparent, secure, and effective.

Whether you're managing multiple cases or need to work in low-connectivity areas, Kriyam.ai provides the technology to meet and exceed the challenges of modern field investigations.

Connect with Kriyam.ai to witness a data-driven, secure, successful insurance verification of the future.

About the author

Suvajit Sengupta

Co-founder & CTO

Suvajit Sengupta | Co-founder & CTO

A passionate technologist who thrives at the intersection of customer needs and innovation. With a track record of building adaptive product teams, he share insights on solving real-world problems with AI and scalable tech solutions.

Interests: AI products, Team Leadership, Data Strategy

Content Overview

Share

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023