Insurance

How Insurers Can Detect & Prevent Different Types of Insurance Fraud

Insurance fraud is a common problem, causing billions of dollars worth of losses every year. According to Indiaforensic, India itself loses about $6.25 billion every year to fraudulent insurance claims. Fraudsters take advantage of the loopholes offered by insurance policies, which lead to increased premiums paid by honest policyholders and tire financial stress on insurers. From health and life insurance fraud to car and credit card insurance fraud, these deceptive practices can take many forms, making it imperative for the insurance providers to install robust fraud detection and prevention mechanisms.

What is Insurance Fraud?

Insurance fraud is defined as the intended perpetration of fraudulent schemes with the aim of obtaining an undue benefit from an insurance company. It often involves inflating claims, falsifying documents, staging accidents, or assuming false identities in order to unjustly collect funds. Insurance fraud may be perpetrated by an individual policyholder, organized crime syndicates, or even by dishonest professionals in the insurance business. Thus, insurance fraud not only kills in terms of money, but it also increases investigations, imposes severe regulations, and raises costs for honest customers. Frauds can be generally categorized as planned and opportunistic fraud. Planned frauds are deliberate schemes methodically executed to deceive over a whole period, while opportunistic frauds are impulsive acts of deception where relatively spontaneous acts of deception occur whenever the individual seizes an unexpected chance to exploit vulnerabilities.

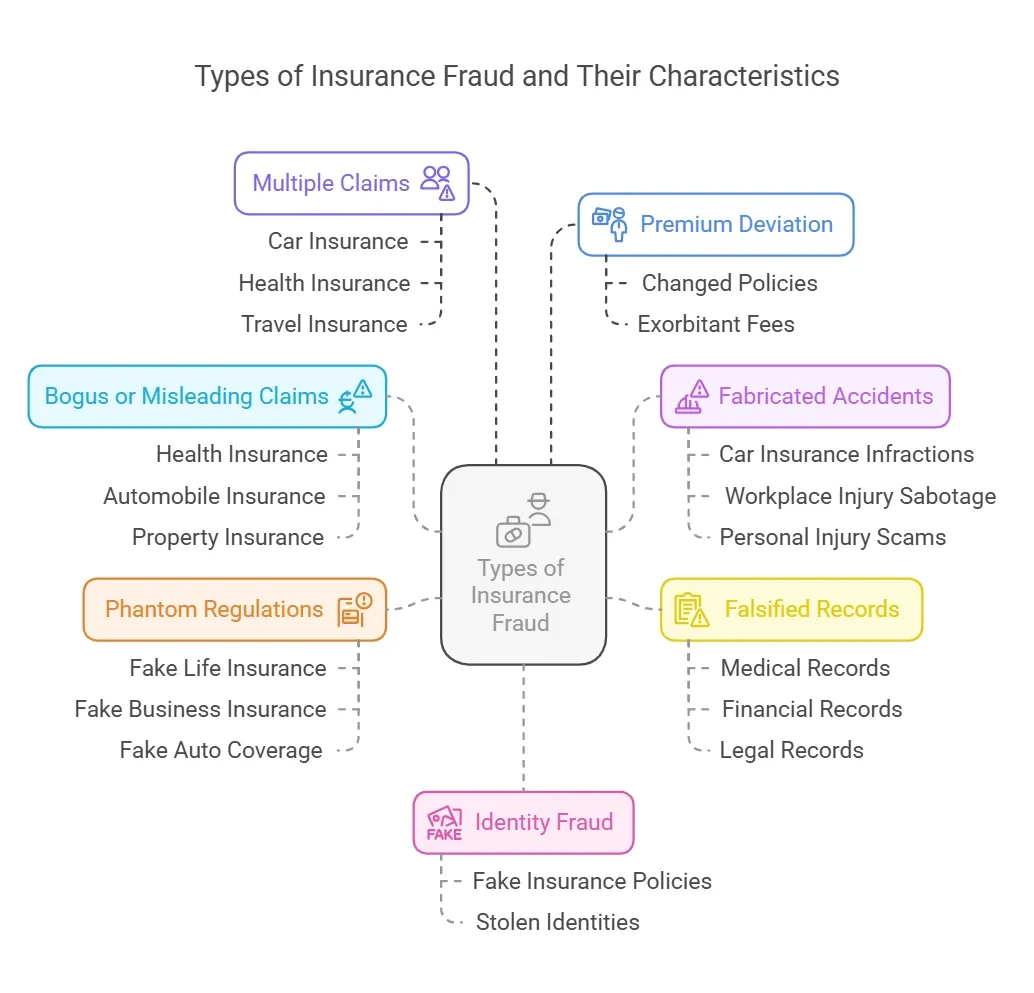

Types of Insurance Fraud

There are many types of insurance fraud, and fraudsters use deceptive tricks to exploit loopholes in various kinds of insurance policies.

Here are some common types of insurance fraud that insurers should watch out for:

1. Bogus or Misleading Claims

This refers to exaggerated or fraudulent claims made so as to take advantage of the highest compensation. This is seen in health insurance, automobile insurance, and property insurance when damage or injury amounts are exaggerated by claimants or blown out of proportion by bogus bills.

2. Fabricated Accidents (Staged Incidents)

Individuals or organized groups cause accidents or injuries to file fraudulent insurance claims. This is represented in car insurance infractions, workplace injury sabotage, and personal injury scams where claimants seek some financial benefits for staged incidents.

3. Falsified Records and False Documentation

Fraudsters would falsify various medical, financial, or legal records to cheat the insurance companies. For life and health insurance, they use false death certificates and fake medical treatments to apply for payouts. For automobile insurance, they would really benefit from changing repair amounts and rewriting damage reports.

4. Premium Deviation (Agent or Broker Fraud)

Insurance agents or brokers who misappropriate premium payments, change policies, or charge exorbitant fees to steal from customers. In many instances, they have occasions to surreptitiously collect premiums without forwarding them to the insurer, leaving policyholders unprotected.

5. Phantom Regulations and Fake Policy Schemes

Scammers create non-existent insurance policies or introduce fake regulations to rightfully fleece customers. Fraudsters sell fake life insurance, business insurance, or auto coverage with no true protection when it comes time for claims.

6. Multiple Claims (Double Dipping)

Fraudsters file multiple claims with several insurers for one incident or exaggerate their losses to make several turns of claims for the same job. It is mostly seen in car, health, and travel insurance when one claimant claims the same loss from two or more insurers.

7. Identity Fraud (Using Fake or Stolen Identities)

Fraudsters start fake insurance policies or use stolen identities to claim fraudulent amounts. Scammers make false claims through the use of stolen cards in the form of insurance fraud. In life insurance, this manifests as creating artificial policyholders in order to take advantage of the life insurance payout based on a misinformation claim regarding the said policyholder's death.

Prevention Strategies

The considerable reduction of insurance fraud could be attained through a course of precise, strong fraud risk mitigation mechanisms and preventive measures. Insurers must engage proactive strategies to identify and stop the fraudster before infinite harm is inflicted. Here are a few important preventive strategies.

1. Advanced Fraud Detection Systems

Insurers shall employ tools of fraud detection powered by artificial intelligence for suspicious claims in real-time. Predictive analytics and machine learning models help detect unusual patterns and flag high-risk transactions.

2. Strict Verification Processes

Long-drawn-out background checks and identity verification processes will eliminate fraud claims. The insurers should confirm the identity of the policyholder through biometric and document verification and through Video KYC for claimants.

3. Data Sharing and Collaboration

Insurance companies should work together, sharing fraud data throughout the industry. A centralized fraud database could keep track of repeat offenders and deny fraudsters access to several insurers.

4. Employee and Agent Monitoring

Routine monitoring and an audit trail of insurance agents and employees will ensure that insider fraud is detected. Enforcement of a very strict compliance policy would ensure that premium misappropriation and policy manipulation are deferred.

5. Public Awareness and Customer Education

Creating awareness among customers about common fraud schemes and their ramifications would prevent customers from resorting to such fraudulent acts. The policyholders should have knowledge about the repercussions and legal punishments associated with insurance fraud.

6. Field Investigation and On-Site Verification

Thorough field investigation processes help the insurer conduct on-site verification of claims to ensure authenticity before liability for payouts is accepted. The use of geo-tagged evidence, real-time AI analyses, and digital documentation can go a long way toward improving the accuracy of fraud detection, especially concerning staged accidents and property damage claims.

How Kriyam Can Help?

Kriyam has come up with a solution to deal with insurance fraud through a powerful AI-based system of field investigation management and Video KYC verification. Centralization of operations ensures fast decision-making and accurate claim analyses from time to time. With Kriyam's platform for field investigations, insurance companies conduct AI-powered visits conducted on-site using geo-tagged evidence. Best suited for exposing fraudulent claims such as staged accidents and vehicles damaged by own policyholders. The platform also helps insurers verify health insurance claims through AI analysis that validates treatments in real-time.

Face recognition with liveness detection in a Video KYC system verifies the authenticity of the identity. This prevents fraudsters from taking advantage of fake or stolen identities in committing life insurance fraud and credit card insurance fraud. By integrating Kriyam's technology, the turnaround will be drastically reduced, while insurers will have a better ability to detect fraud and also faster completion of the whole investigation itself.

Final Thoughts

Insurance fraud has continued to challenge insurers and sincere stakeholders. The exploits will include staged accidents, bogus documentation, and identity theft. In fighting these threatening developments, insurers will have to come up with modern computer-based fraud detection systems paired with competent verification processes and educate the customer about fraudulent activities. Kriyam's AI-powered investigation platform and Video KYC verification allow insurers the means to accurately detect and prevent fraud. Using these capabilities, insurance companies can boost fraud detection, thereby, reducing financial losses and shielding genuine policyholders from increasing premium costs.

People Also Ask

1. What are the most common types of insurance fraud?

The most common types include bogus claims, staged accidents, falsified records, agent fraud, multiple claims, and identity fraud.

2. How does health insurance fraud occur?

Health insurance fraud occurs when policyholders submit fake medical bills, exaggerate treatments, or collude with healthcare providers to claim benefits for non-existent procedures.

3. What are the consequences of insurance fraud?

Insurance fraud can lead to legal penalties, financial losses for insurers, increased premiums for policyholders, and loss of trust in the insurance industry.

4. How can insurance companies prevent fraud?

Insurance companies can prevent fraud by using AI-powered fraud detection tools, verifying customer identities through Video KYC, monitoring agents, and educating policyholders about fraud risks.

5. How does Kriyam help in detecting insurance fraud?

Kriyam provides an AI-driven investigation platform and Video KYC verification system that enables real-time claim validation, identity authentication, and fraud detection to prevent fraudulent activities in insurance.

Kriyam.ai Content Team

28th February, 2025

Latest

LATEST BLOGS

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023