The Future of Insurance Industry with Process Automation

Suvajit Sengupta | 29th December, 2023

3 min reads

Suvajit Sengupta | 29th December, 2023 | 3 min reads

Introduction

Imagine you're at your desk, navigating through the latest insurance software, realizing you're spending more time on routine data entry than actual client interactions. You're not alone in this digital era where the balance between technology and personal touch is crucial.

Now, what if there's a seamless way to blend these worlds? Enter the realm of process automation in the insurance industry.

In today's fast-paced environment, being bogged down by manual tasks can feel like a step back. But here's the kicker: automation is not just about keeping up with the times; it's about setting the pace.

In this blog, we're going to uncover how process automation is reshaping the insurance landscape, making tasks quicker, error-free, and, most importantly, customer-centric.

From innovative claims processing to AI-driven customer insights, we'll delve into how automation is not just a tool but a strategic ally for insurance professionals like you.

The Historical Context of Insurance and the Need for Change

Have you ever wondered how the insurance industry got to where it is today? It's a journey that's as fascinating as it is enlightening.

Let's take a stroll down memory lane and see how things have evolved, shall we?

From Humble Beginnings to Complex Systems

The Early Days: Picture this – it's ancient times. Merchants are sending their goods across treacherous seas. To mitigate the risk of loss, they came up with a plan: distribute their cargo across multiple ships. That's the seed of insurance – sharing risk.

Fast Forward to the 17th Century: We land in the era of the first insurance company in London. It's all about marine insurance back then. But soon, the concept expands to cover more aspects of life and business.

Industrial Revolution and Beyond: With the industrial boom, the insurance industry grew in complexity. New risks, new policies. It's not just about ships and cargo anymore. We're talking life insurance, property insurance, and so much more.

Hitting Roadblocks: The Challenges of Traditional Models

But here's the catch: as the industry grows, so do its challenges. Let's break it down:

Manual Processing Galore: Think about the mountains of paperwork, the endless data entry, and the painstaking calculations. It's all done by hand. Time-consuming? Absolutely. Error-prone? You bet.

Inefficiencies at Every Turn: With manual processes come inefficiencies. Processing claims takes ages. Policy underwriting is like navigating a maze. And let's not even get started on customer service delays.

Sky-High Operational Costs: All these manual processes don't just eat up time; they devour costs, too. More staff, more resources, more everything. And who ends up bearing the brunt of these costs? Often, it's the customers.

The Need for a Revolution

So, what's the solution? Well, that's where our story takes a turn. The industry has started to realize that to keep up with the times and the competition, it needs a makeover. A digital makeover.

Embracing Technology: The dawn of the digital age opens up new possibilities. Computers have started to replace file cabinets. But that's just the beginning.

Enter Process Automation: This is the game-changer. Imagine automating those tedious tasks. Claims processing that takes days now takes hours or even minutes. Underwriting that's not just faster but also more accurate.

And guess what? This is not a distant dream. It's happening right now. The future of insurance is unfolding before our eyes, and it's all about being smarter, faster, and more efficient.

So, are you ready to dive into how process automation is making this happen? Let's keep moving forward and find out!

The Advent of Process Automation in Insurance

Now, let's turn the page to one of the most exciting chapters in the insurance industry's story: the advent of process automation. But first, let's clear the air about what process automation really means. Ready to dive in?

Unpacking Process Automation

What Is Process Automation?: In simple terms, process automation is like having a virtual assistant who never sleeps. It's all about using technology to automate repetitive and routine tasks. This means less manual work and more time for the stuff that really matters.

The Tech Trio: At the heart of process automation are three key players:

Artificial Intelligence (AI): Think of AI as the brain. It's smart, it learns, and it makes decisions. AI in insurance can analyze patterns, predict outcomes, and even interact with customers.

Machine Learning: This is AI's self-improving aspect. Machine learning algorithms get better over time, learning from past data to make smarter decisions in the future.

Robotic Process Automation (RPA): RPA is the hands of the operation. It handles repetitive tasks like data entry, form filling, and even email responses.

The Shift Begins

Early Adoption: The initial integration of process automation in insurance industry wasn't an overnight sensation. It started with simple tasks. Think automated email responses or data entry. But even these small steps made a big difference.

Gaining Momentum: As the industry began to see the benefits – faster processing times, reduced errors, and happier customers – the momentum for automation grew. Insurers started to look at bigger and more complex processes that could be automated.

Related Read - The Role of AI in Streamlining Insurance Processes and Services

Embracing the Digital Shift

From Skepticism to Acceptance: Sure, there was skepticism at first. Change is never easy. But as the tangible benefits became clear, the industry started to embrace process automation with open arms.

A Transformative Impact: The impact of this shift is profound. We're talking about a complete overhaul of traditional methods. Processes that used to take days are now done in hours or even minutes. And the accuracy? Unparalleled.

So, what does this mean for the insurance industry? It's simple: Process automation is not just a trend; it's the new standard. It's about working smarter, not harder. It's about giving customers what they want – efficiency and accuracy.

As we move forward, remember this: the adoption of process automation in insurance is just the beginning. The possibilities are endless, and the future is bright. Are you excited to see where this journey takes us? I know I am!

Transforming Insurance Operations with Automation

Alright, let's get to the heart of the matter. How exactly is process automation transforming the nuts and bolts of the insurance industry? From claims processing to customer service, the impact is revolutionary. Let's break it down, shall we?

Revolutionizing Claims Processing

Speed is Key: Gone are the days of waiting weeks for a claim to be processed. Automation speeds up the entire process, from filing to settlement. How? By automating data entry and validation, claims can be processed in a fraction of the time.

Reducing Errors: Human error in claims processing? It's significantly minimized. Automated systems are meticulous and consistent, ensuring accuracy every step of the way.

Improved Turnaround Times: Customers no longer need to wait endlessly for their claims to be resolved. Faster processing means happier customers and a better reputation for your agency.

Related read - How Automation is Changing the Landscape of BFSI Investigations

Underwriting: A Data-Driven Approach

Enhanced Risk Assessment: With automation, underwriting isn't just faster; it's smarter. By leveraging data analytics, insurers can assess risks more accurately. This means better decision-making and more tailored policy pricing.

Streamlined Policy Pricing: Automation tools analyze vast amounts of data to help set premiums that are fair and competitive. This isn't just guesswork; it's precision at its finest.

Customer Service: Automated Yet Personal

24/7 Availability: Automated chatbots and AI-driven support systems mean that help is always available, day or night. Customers get their questions answered anytime, improving overall satisfaction.

Personalized Interactions: Think automation is impersonal? Think again. AI can analyze customer data to provide personalized advice and solutions, making every interaction feel tailor-made.

Policy Management: Simplified and Compliant

Effortless Administration: Automation streamlines policy management from start to finish. Renewals, updates, and modifications are handled with ease, reducing administrative burdens.

Ensuring Compliance: Keeping up with regulations is a breeze with automation. Automated systems stay updated on legal changes, ensuring that your policies are always compliant.

So, what's the takeaway here? Process automation is transforming insurance operations in ways we never thought possible. It's not just about doing things faster; it's about doing them better. From claims to customer service, automation is setting a new standard in the insurance industry.

Ready to see what else is in store for the future of insurance? Stay tuned because the possibilities are endless!

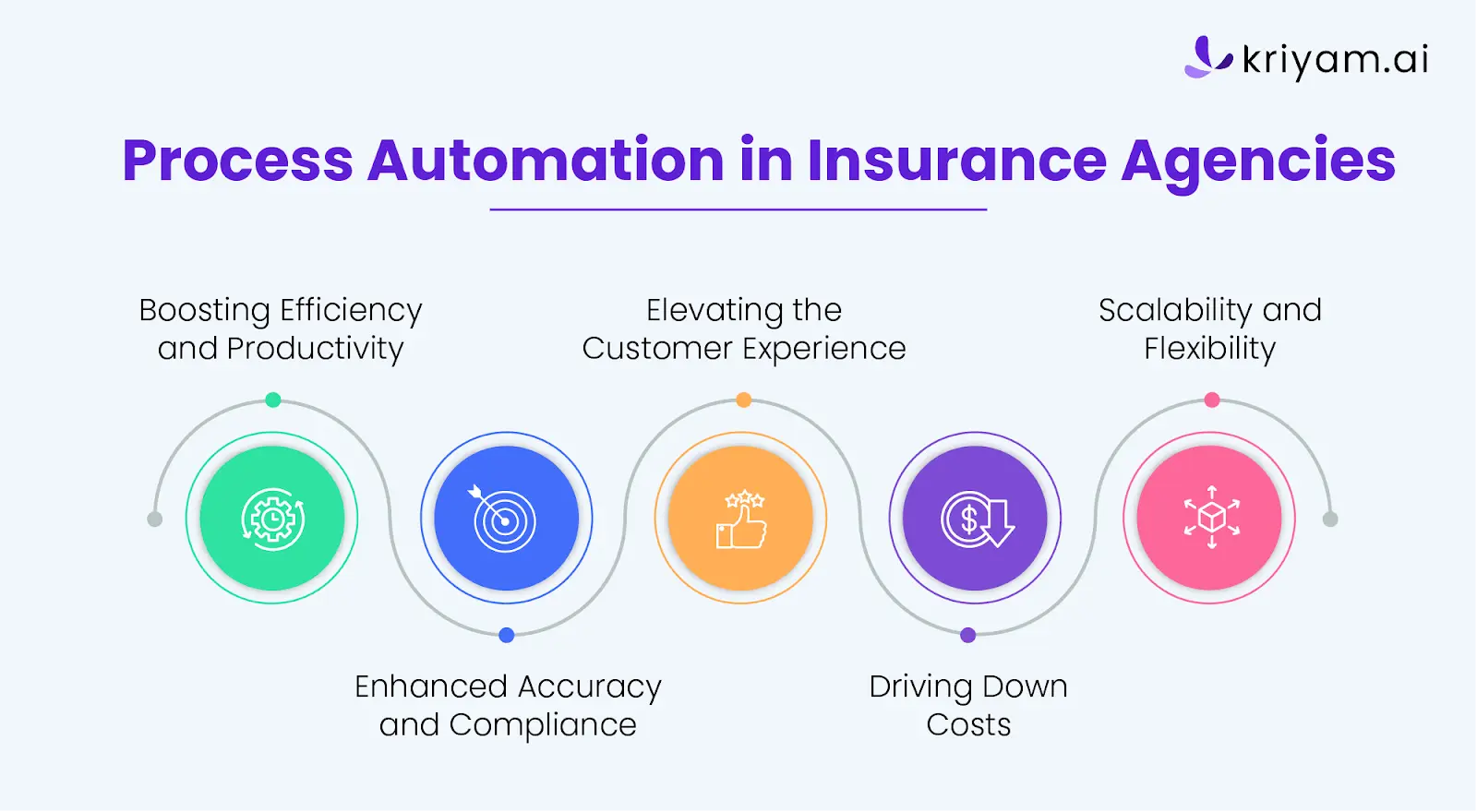

Advantages of Using Process Automation in Insurance Agencies

Let's face it: the insurance world can be a complex maze, but guess what? Process automation is like having a GPS that guides you through it effortlessly. Intrigued?

Let's delve into the myriad of advantages that process automation brings to the table for insurance agencies.

Boosting Efficiency and Productivity

Automating the Mundane: Imagine a world where routine tasks like data entry, policy renewals, and claim processing are automated. That's more time for your team to focus on what they do best – crafting tailored insurance solutions and nurturing client relationships.

Streamlined Workflows: Automation integrates disparate systems, ensuring that information flows seamlessly from one process to another. This means tasks that used to take hours now take minutes. Efficiency? Skyrocketed.

Enhanced Accuracy and Compliance

Minimizing Human Error: Let's be real, we're only human, and errors happen. But with automation, these slip-ups are drastically reduced. Automated systems are precise, ensuring that every 'i' is dotted and every 't' is crossed.

Staying on Top of Regulations: The insurance industry is no stranger to regulations. Automation helps you stay compliant, automatically updating systems with the latest regulatory changes. Peace of mind? Guaranteed.

Elevating the Customer Experience

Speedy Service: In a world where time is of the essence, customers expect quick responses. Automation accelerates claim processing and policy issuance, meaning customers get what they need faster than ever before.

Personalization at Its Best: Automation tools, armed with data analytics, provide insights that enable you to offer personalized services to your clients. Tailored advice and solutions? That's the kind of service that turns customers into loyal fans.

Driving Down Costs

Reducing Operational Expenses: Think about the costs associated with manual processing – it adds up, right? Automation cuts down these expenses significantly. Fewer errors mean fewer resources spent on correcting them, and faster processing means less time spent on each task.

Maximizing Resource Allocation: With routine tasks automated, your team can focus on more strategic initiatives. This means you're getting the most out of your human resources, and who doesn't want that?

Scalability and Flexibility: Adapting with Ease

Growing Without the Pains: As your agency grows, so does the workload. Automation scales with your business, handling increased volumes without the need to exponentially increase your workforce.

Flexibility to Meet Market Demands: The insurance market is ever-changing. Automation provides the agility to quickly adapt to new market conditions, customer needs, and regulatory changes.

The Role of AI and Machine Learning in Insurance Automation

Now, let's talk about the real game-changers in insurance automation: AI and Machine Learning. These aren't just buzzwords; they're the powerhouses driving the industry into a new era. Curious about how they fit into the big picture? Let's dive in!

AI and Machine Learning: The Dynamic Duo in Automation

More Than Just Automation: While process automation handles repetitive tasks, AI and Machine Learning bring in the brains. They analyze, learn, and make decisions, taking automation from basic to brilliant.

Learning on the Go: Machine Learning algorithms thrive on data. The more they process, the smarter they get. This means every interaction and transaction makes your system more efficient and more attuned to your needs.

Predictive Analytics in Underwriting

Risk Assessment Reimagined: Gone are the days of solely relying on historical data and gut feelings for underwriting. AI-driven predictive analytics look at patterns and trends, predicting risks more accurately than ever before.

Tailored Policy Pricing: Imagine being able to offer policy pricing that's as unique as your customers. Predictive analytics make this a reality, assessing individual risk profiles and customizing pricing to match.

Personalized Insurance Services: A New Frontier

Understanding Your Customers: AI doesn't just process data; it understands it. This means being able to offer personalized insurance services based on individual customer behaviors, preferences, and needs.

Enhancing Customer Engagement: Machine Learning algorithms can identify cross-selling and upselling opportunities, suggesting relevant additional coverages to customers based on their profiles and past interactions.

The Impact of AI and Machine Learning

Efficiency and Accuracy: With AI and machine learning, processes become not only faster but also smarter. This duo ensures that the right decisions are made quickly and accurately.

Staying Ahead of the Curve: In a competitive market, staying ahead is key. AI and Machine Learning give you that edge, constantly evolving and keeping you at the forefront of innovation.

So, what's the takeaway? AI and Machine Learning are transforming the insurance industry from the inside out. They're not just supporting roles in the automation story; they're leading characters, driving the plot towards more efficient, accurate, and personalized insurance services.

Conclusion

In conclusion, the journey through the insurance industry's evolution reveals a clear path forward: embracing process automation is not just an option but a necessity for future success.

From the historical context to the transformative role of AI and Machine Learning and the exciting trends on the horizon, it's evident that automation is the key to increased efficiency, accuracy, and personalized customer service.

As we stand at the brink of these technological advancements, the message is clear – for insurance agencies looking to thrive in a rapidly evolving landscape, now is the time to adapt, innovate, and embrace the power of process automation.

The future of insurance is bright and automated, and the opportunity to be a part of this revolution is right at your fingertips. Try Kriyam.ai, the best insurance automation software for better insurance management.

Suvajit Sengupta

Co-founder & CTO

Suvajit Sengupta | Co-founder & CTO

A passionate technologist who thrives at the intersection of customer needs and innovation. With a track record of building adaptive product teams, he share insights on solving real-world problems with AI and scalable tech solutions.

Interests: AI products, Team Leadership, Data Strategy

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023