Automation

Online Account Opening Video KYC Software for Customer Onboarding

The financial sector is witnessing a transformative shift with the integration of Online Account Opening Video KYC (Know Your Customer) Software into customer onboarding processes.

This modern approach transcends traditional methods, introducing a streamlined, secure, and highly user-friendly platform for remote identity verification.

As financial institutions grapple with the challenges of ensuring security and compliance in an increasingly online world, Video KYC emerges as a key solution. This blog aims to explore the nuances of this technology, highlighting its significant impact on customer onboarding, its myriad benefits, and the way it is redefining industry standards.

We will delve into how Video KYC Software not only enhances customer experience but also aligns with regulatory demands, offering a comprehensive view of its role in the evolving landscape of financial services.

Let's get started!

Understanding AI-Powered Video KYC in Online Account Opening

AI-powered Video KYC (Know Your Customer) revolutionizes how financial institutions handle customer identification and verification, especially in online account opening. This technology blends video conferencing with artificial intelligence to streamline the KYC process. Here's a closer look at how it works.

Remote KYC Process via Video Call

- Customers can complete the KYC process remotely using a video call.

- AI enhances the efficiency and accuracy of this process, which is ideal for opening an online account.

AI greatly improves the online account opening procedure by increasing accuracy and efficiency. In the digital era, it speeds up and improves the reliability of the verification processes, which benefits businesses as well as customers.

Integration of Facial Recognition Technology

- During the video call, facial recognition compares the customer's live image with their photo ID.

- AI algorithms accurately confirm the identity, significantly reducing identity fraud risks.

Read more about Facial Recognition Technology

Use of Optical Character Recognition (OCR)

- OCR technology scans and extracts data from documents like driver's licenses or passports presented during the video call.

- It verifies the extracted information against the customer's provided details for consistency and accuracy.

Incorporating Biometric Verification

- Biometric methods such as voice recognition or fingerprint scanning are often used.

- These add an extra security layer, making it difficult for impostors to pass the verification process.

AI-powered Video KYC has a significant overall impact on the banking and financial industries. It provides a more safe, effective, and convenient onboarding process for starting an online account. By simplifying the verification procedure, this technique greatly improves security and integrity.

Advantages of AI-Powered Video KYC

1. Enhanced Fraud Prevention

- AI-powered Video KYC significantly boosts security measures crucial for fraud prevention.

- Advanced technologies like facial recognition and document verification accurately confirm the identity of customers, drastically reducing the chances of fraudulent activities.

2. Improved Compliance with Regulatory Requirements

- This KYC software aids in maintaining compliance with stringent regulatory requirements in the financial sector.

- It ensures thorough and precise verification processes, meeting the high standards set by regulatory bodies.

3. Higher Customer Satisfaction

- The speed and accuracy of AI-powered Video KYC lead to a faster onboarding process, enhancing customer satisfaction.

- Customers appreciate the streamlined and hassle-free experience, fostering a positive first impression of financial services.

The onboarding of new clients in the banking and financial industries is being completely transformed by AI-powered video KYC software. Increased security and compliance, as well as process efficiency and error-free execution, all contribute to increased customer satisfaction. In the age of digital banking today, remote verification is an essential tool because of its added usefulness.

Impact of AI-Powered Video KYC on BFSI

Banking Sector

- Due to its significant cost reductions and increased efficiency, video KYC is completely changing the banking industry. It provides an efficient and economical digital, paperless approach that does away with the necessity for in-person meetings.

- When compared to conventional KYC procedures, Video KYC can save up to 90%. It also adheres entirely with all legal requirements, including RBI regulations. As a result, it offers a comprehensive and effective customer onboarding solution that combines cost savings, convenience, and compliance.

Insurance Industry

- In insurance, this technology simplifies the verification of customer identities, which is vital during policy issuance and claims processes.

- It ensures the submitted documents are authentic, minimizing fraud and expediting claim resolutions.

Financial Services

- The finance sector is highly competitive. If a business is unable to finish the KYC, it will result in a loss of possible business. The KYC verification procedure, which was formerly estimated to take 10–20 days, can now be finished in 10 minutes thanks to extensive automation and digitization.

- Many modern fintech companies are springing up, providing excellent client onboarding, knowing your customers (KYC), and eventually providing a variety of financial goods, all thanks to the video KYC check. Customers would benefit from this since they may now easily access superior financial products and services while remaining indoors.

Additionally, this implies that established companies must quickly change and digitize their operations to avoid losing out on the whole next generation of business.

Property Management

While not traditionally part of BFSI, property management firms benefit from AI-powered Video KYC. It assists in reliably verifying tenant and investor identities, an essential step in property-related financial transactions. Streamlining the verification process helps in faster lease approvals and reduces the risk of rental fraud.

In all these sectors, AI-powered Video KYC transforms how companies handle the list of KYC documents. It brings accuracy, speed, and enhanced security to processes that were once manual and time-consuming.

This improves operational efficiency and significantly enhances customer satisfaction and trust in BFSI services.

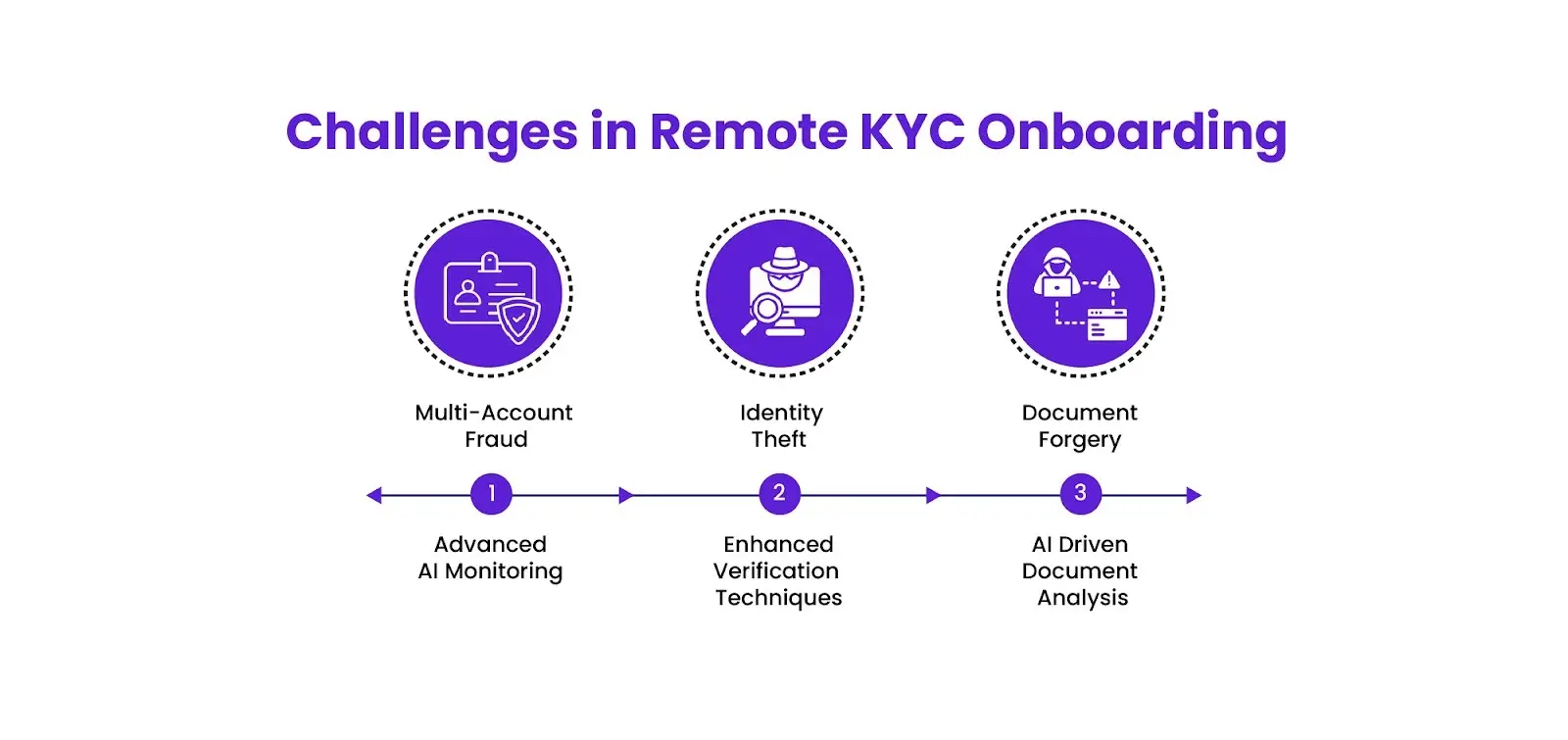

Challenges and Solutions in Remote KYC Onboarding

Banner content:

- Challenge-Multi-Account Fraud Solution: Advanced AI Monitoring

- Identity Theft Solution: Enhanced Verification Techniques

- Document Forgery Solution: AI Driven Document Analysis

Multi-Account Fraud

Multi-account fraud involves an individual creating multiple accounts under different identities. It's a prevalent issue in digital banking and financial services. This type of fraud can be used for money laundering, credit scams, and other illegal activities. It undermines the security of the financial system and can lead to significant financial losses. It threatens the institution's credibility and may lead to unchecked regulatory sanctions.

Solution: Advanced AI Monitoring

- AI systems use sophisticated algorithms to analyze behavior patterns and transaction histories.

- They can detect anomalies that suggest the same individual controls multiple accounts.

- By flagging such suspicious activities, AI allows institutions to take timely action, such as account freezes or additional verifications, thus preventing potential fraud.

Identity Theft

- Identity theft occurs when someone wrongfully acquires and uses another person's data for fraud. This can happen in online KYC processes where sensitive data is shared.

- It can lead to unauthorized account access, financial losses for individuals, and damage to the institution's reputation.

Solution: Enhanced Verification Techniques

- AI integrates biometric verification (like facial recognition and fingerprint scans) with traditional data points.It ensures the person undergoing KYC is the actual owner of the submitted documents.

- These advanced methods make it significantly more difficult for fraudsters to impersonate others, thus safeguarding the individual's identity.

Document Forgery

- Document forgery in KYC involves altering or fabricating documents to create false identities or credentials. This can lead to unauthorized access and regulatory breaches.

- It's a severe challenge as sophisticated forgeries can be hard to detect, posing threats to financial security and compliance.

Solution: AI-Driven Document Analysis

- AI uses OCR and other document analysis technologies to scrutinize documents for authenticity. It checks for signs of tampering or inconsistencies in the document's details.

- Continuous learning algorithms in AI systems help them stay updated on the latest forgery techniques, maintaining a high-security standard in document verification.

- While remote KYC onboarding is fraught with multi-account fraud, identity theft, and document forgery, AI-powered solutions offer a robust defense.

These AI-driven tools enhance the security and efficiency of KYC verification online, offering a more secure environment for customers and financial institutions.

Through constant monitoring and advanced verification techniques, AI is pivotal in mitigating the risks associated with remote KYC processes.

Also Read about AI-Driven Field Verification Software

Conclusion

In conclusion, the advent of Online Account Opening Video KYC Software has revolutionized the remote onboarding process for BFSI. By integrating cutting-edge technology and ensuring compliance with regulatory requirements, this software has streamlined the onboarding experience, making it more efficient, secure, and user-friendly.

AI produces:

- Accurate and Reliable Verification: Artificial Intelligence speeds up procedures and ensures accuracy by avoiding bureaucracy.

- Enhanced Security: AI's advanced algorithms serve as a strong defense against fraud, giving both institutions and consumers peace of mind.

- User-friendly Experience: AI-powered systems have a user-friendly design, allowing for convenient and comfortable remote verification.

But the innovation doesn't stop here. Since AI can adapt and learn, services can keep getting better, resulting in:

Affordable Procedures: This leads to significant cost savings for the company, with the potential to pass those savings on to clients.

Increased Satisfaction with Customers: A seamless onboarding experience that leaves a lasting good impression Prepare yourself to enter the world of online account opening in the future, when productivity, security, and client happiness will reach new heights.

For your digital onboarding requirements, take a look at Kriyam.ai, which provides an excellent AI-powered video KYC solution.

Try Kriyam.ai now to see efficiency and creativity together, and see how it can change the customer onboarding procedure.

Suvajit S

23rd January, 2024

Latest

LATEST BLOGS

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023