InsureTech Solutions: Revolutionizing the Insurance Agencies Landscape

Suvajit Sengupta | 28th December, 2023

4 min reads

Suvajit Sengupta | 28th December, 2023 | 4 min reads

Introduction

Insuretech is evolving at a rapid pace, and the traditional insurance model is undergoing a seismic shift. Much like an old, reliable car being turbocharged for today's fast-paced BFSI highway.

InsureTech isn't just a buzzword; it's a transformative force reshaping the insurance landscape. It's about leveraging cutting-edge technology to revitalize your business model, making it more agile, customer-centric, and efficient.

Consider this: Deloitte's 2024 insurance outlook underscores the urgency for insurers to adapt to escalating global risks and shifting customer expectations. InsureTech is at the heart of this evolution, offering tools to enhance customer engagement and streamline operations.

We understand the challenges you face – staying competitive, meeting customer demands, and navigating complex regulations. InsureTech is your ally in this journey, offering solutions to these pressing issues.

In this blog, we'll explore how InsureTech bridges the gap between traditional methods and modern needs.

Let's get started to know about the digital transformation in insurance.

The Evolution of InsureTech in BFSI

A Journey Through Time

From Paper to Pixels: Remember when insurance was all about heaps of paperwork and manual underwriting? The BFSI sector has come a long way from those days. The journey from ledger books to digital databases marks significant milestones in the industry.

Key Milestones: Let's rewind and look at some pivotal moments. The introduction of computerized systems in the 1960s, the advent of the internet in the 1990s, and the rise of e-commerce platforms in the early 2000s all set the stage for today's InsureTech revolution.

The Tech Trio Transforming Insurance

AI: The Smart Player: Artificial Intelligence (AI) is like the brainy kid on the block, changing how insurers assess risks and interact with customers. From chatbots that handle customer queries to algorithms predicting risk profiles, AI is a game-changer.

IoT: The Connector: Internet of Things (IoT) devices are the connectors that provide real-time data that insurers use to tailor policies and prevent losses. Think smart homes and telematics in cars – they're reshaping insurance from reactive to proactive.

Big Data: The Knowledge Base: Big data is the treasure trove of insights. Insurers are now able to analyze vast datasets to understand customer behavior, predict trends, and make informed decisions.

A New Insurance Landscape

Personalized Policies: Gone are the days of one-size-fits-all. InsureTech enables more personalized insurance products that are tailored to individual needs and lifestyles.

Efficiency and Speed: Claims processing and policy issuance are now faster and more efficient, thanks to automation and AI.

Risk Management: With IoT and big data, insurers are better equipped to manage and mitigate risks before they escalate.

Understanding the Gap in Traditional Insurance Practices

The Old School Challenges

Inefficiency and Inaccuracy: Traditional insurance models often involve time-consuming processes and a higher likelihood of human error. This inefficiency isn't just a headache; it's a bottleneck that hampers growth.

Lack of Personalization: The old ways often mean generic policies that may not suit everyone's needs. In today's world, that doesn't fly. Two Sides of the Same Coin

From the Consumer's Viewpoint: Imagine being a customer stuck with a policy that doesn't quite fit your needs or waiting weeks for a claim to be processed. Frustrating, right?

Through the Provider's Lens: Now, put on the insurer's hat. Dealing with mountains of paperwork, managing risks with limited data, and struggling to keep up with customer expectations can be overwhelming.

Why Modernization is Non-Negotiable

Keeping Up with the Times: In a world where technology is constantly advancing, sticking to outdated methods is like trying to win a race with a horse and carriage. It's not just about staying relevant; it's about survival.

Meeting Customer Expectations: Today's customers expect quick, convenient, and personalized services. InsureTech is not just a fancy add-on; it's a necessity to meet these expectations.

Staying Ahead of Risks: With the increasing complexity of risks, especially in the digital space, traditional methods fall short. InsureTech provides the tools needed to stay ahead and stay safe.

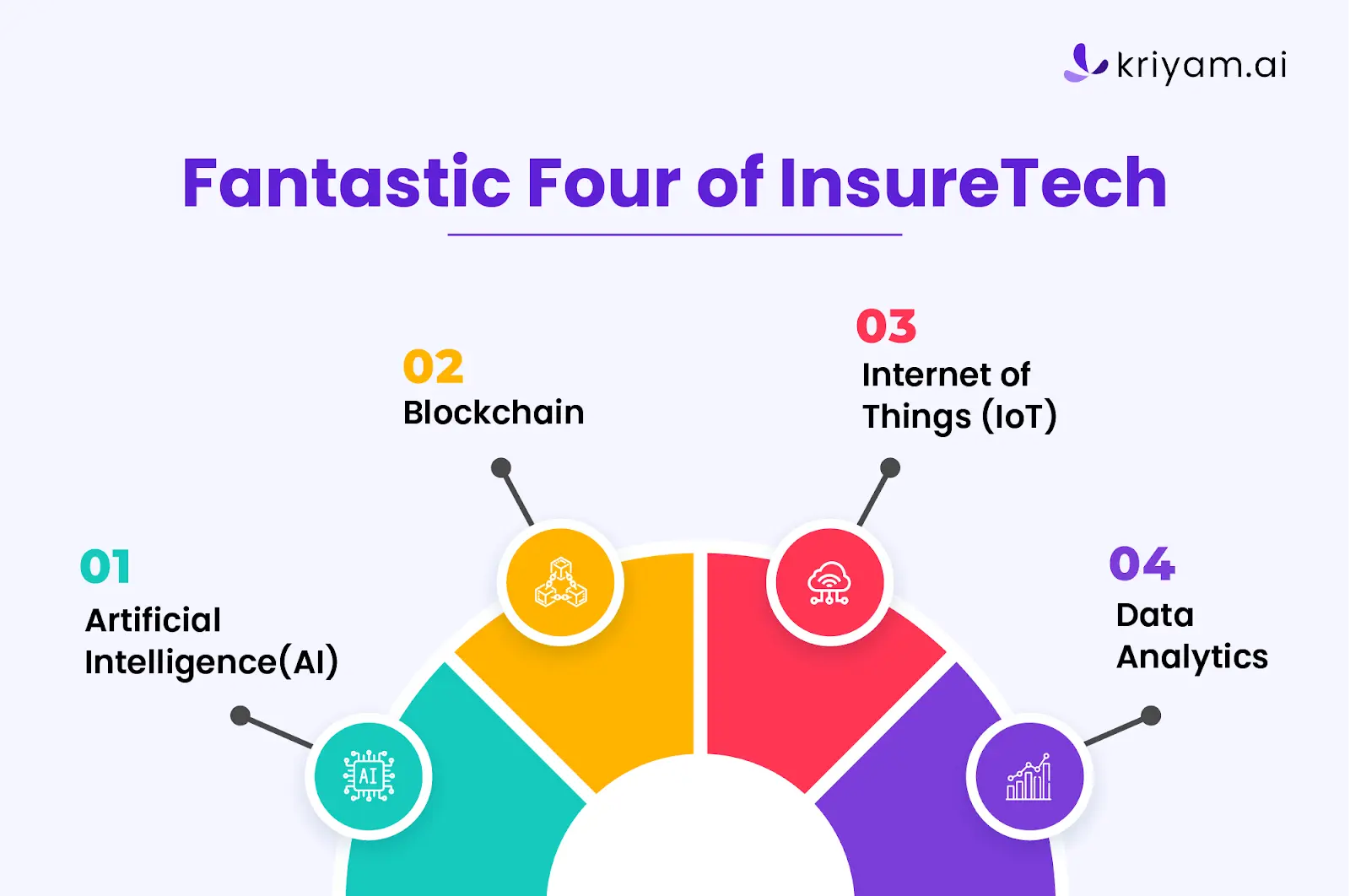

Key Technologies Driving InsureTech - The Fantastic Four

AI: The Brain Behind the Operation

What It Does: AI in InsureTech is like having a super-smart assistant that predicts risks, personalizes customer interactions, and automates mundane tasks.

In Action: Think of AI-powered chatbots that assist customers 24/7 or algorithms that swiftly process claims by analyzing data patterns.

Blockchain: The Trust Anchor

What It Does: Blockchain brings transparency and security to insurance transactions. It's like a digital ledger that's tamper-proof and transparent.

In Action: Consider smart contracts in blockchain that automatically execute insurance policies, ensuring trust and efficiency. Learn how AI is making an impact on insurance agency operations.

IoT: The Data Dynamo

What It Does: IoT devices collect real-time data, offering insights into customer behavior and risk assessment.

In Action: Picture telematics in vehicles that help insurers tailor auto insurance rates based on driving behavior.

Data Analytics: The Insight Generator

What It Does: Data analytics turns vast amounts of data into actionable insights, helping insurers make informed decisions.

In Action: Imagine insurers using big data to predict trends, assess risks, and design products that meet specific customer needs.

Enhancing Customer Experience with InsureTech

Let’s have a deep dive into how insuretech rapidly increases customer experience.

Customer-Centric Approaches: Putting Customers First

The Shift: InsureTech is pivoting the BFSI sector from product-focused to customer-centric models. It's all about understanding and meeting customer needs more effectively.

In Practice: This means using tech to offer personalized experiences, quicker service, and more engagement channels.

Realistic Examples

- A health insurance company uses AI to offer personalized health plans based on individual health data, resulting in higher customer satisfaction.

- An auto insurer uses telematics to reward safe drivers, leading to increased customer loyalty and lower claim costs.

Measuring Success: The Proof Is in the Numbers

Customer Satisfaction Scores: Higher scores indicate better customer experiences, thanks to personalized and efficient services.

Engagement Metrics: Increased interactions on digital platforms show higher customer engagement levels.

Retention Rates: Higher retention rates suggest that customers are happy with the services and are less likely to switch providers.

Overcoming Challenges and Risks in InsureTech Adoption

So no good things without challenges, insure is the same. Let’s see what we need to look at while coming for the challenges faced..

Navigating the Common Hurdles

Data Security: In the digital age, data breaches are like storms on the horizon – unpredictable and potentially devastating. InsureTech, with its reliance on vast data, faces significant security challenges.

Regulatory Hurdles: The BFSI sector is a maze of regulations. With InsureTech, navigating this complex regulatory landscape becomes even more intricate.

Risk Mitigation Strategies: Charting a Safe Course

Robust Cybersecurity Measures: Implementing advanced security protocols and encryption is like building a digital fortress to safeguard data. Staying Abreast of Regulations: Keeping up-to-date with regulatory changes is crucial. It's like having a GPS to navigate the regulatory landscape.

Regular Audits and Compliance Checks: Conducting frequent audits ensures you're not veering off the compliance track.

Best Practices: The Roadmap to Success

Collaboration with Tech Experts: Partnering with technology experts can be a game-changer. It's like having a co-pilot in your InsureTech journey.

Employee Training and Awareness: Equip your team with the knowledge and skills to handle new technologies. Think of it as training your crew for a new voyage.

Customer Education: Educating customers about the benefits and use of new tech can enhance trust and adoption.

Future Trends and Predictions in InsureTech

Emerging Trends: The Winds of Change

AI and Machine Learning: These technologies are set to become more sophisticated, offering even deeper insights and automation.

Blockchain Beyond Smart Contracts: Expect blockchain to play a bigger role in fraud prevention and claim verification.

Personalized Insurance Products: Tailored insurance based on individual behavior and preferences will likely become the norm.

Predictive Analysis: Peering into the Crystal Ball

Increased Automation: The future points towards more automation in underwriting and claims processing, reducing human intervention and errors.

Rise of Telematics and Wearables: These devices will provide more personalized data, leading to customized insurance policies.

Greater Emphasis on Customer Experience: InsureTech will continue to focus on enhancing customer interaction and service.

Preparing for the Future: Staying Ahead of the Curve

Invest in Emerging Technologies: Staying current with technological advancements is key. It's like keeping your ship equipped with the latest navigation tools.

Adopt a Flexible Business Model: Be ready to adapt to changing market dynamics. Flexibility is your anchor in the ever-changing BFSI seas.

Focus on Customer-Centric Solutions: Keep the customer at the heart of your InsureTech initiatives. Satisfied customers are the best compass for success.

Benefits of InsureTech for Insurance Companies and Agents Let’s see how both insurance companies and insurance agencies can benefit from insuretech.

Benefits for Insurance Companies

Enhanced Data Analytics and Risk Assessment

InsureTech allows insurance companies to harness the power of big data for more accurate risk profiling. Companies can identify patterns and trends that traditional methods might miss by analyzing vast datasets.

Streamlined Operational Efficiency

InsureTech introduces automation in routine tasks and claims processing, significantly reducing manual effort and the potential for human error. This automation leads to a substantial reduction in operational costs and faster processing times. A study showed that automation could cut down claim processing times by up to 70%.

Improved Product Development and Innovation

InsureTech enables companies to develop insurance products tailored to specific customer needs, using insights gained from customer data.

Enhanced Customer Engagement and Satisfaction

By utilizing digital platforms, insurance companies can offer more engaging and interactive customer experiences. Companies have reported increased customer satisfaction and retention rates, with one insurer seeing a 20% increase in customer loyalty after adopting InsureTech solutions.

Regulatory Compliance and Fraud Detection

Technology simplifies meeting regulatory requirements, with automated systems ensuring compliance. InsureTech tools have been instrumental in identifying and preventing insurance fraud, saving companies millions annually.

Benefits for Insurance Agents

Empowerment Through Tools and Resources

InsureTech provides agents with sophisticated tools for customer management and engagement, enhancing their ability to serve clients effectively.

Using tools like Kriyam.ai, agents can perform better investigations faster and in a very simple manner.

Personalized Customer Interactions

Agents can leverage customer data to provide personalized insurance advice and offerings.

Efficiency in Sales and Customer Management

Automation and AI help in efficiently managing customer portfolios, reducing the time spent on administrative tasks.

Generating More Detailed Reports with Simple Automation

Insurance investigation agencies are revolutionizing report generation through simple automation. By leveraging technology, these agencies can compile comprehensive, detailed reports more accurately and efficiently.

Conclusion

In conclusion, the journey through the dynamic world of InsureTech reveals its transformative impact on the insurance sector. From enhancing data analytics and operational efficiency to fostering innovative product development and customer satisfaction, InsureTech is reshaping the insurance landscape.

It's clear that embracing these technological advancements is not just a trend but a necessity for staying competitive and relevant. For insurance companies and agents, now is the time to harness the power of InsureTech.

By adopting these technologies, you're not only optimizing your operations but also positioning yourself at the forefront of a rapidly evolving industry. Let's embrace this tech-driven future and unlock new potential in the insurance sector.

About the author

Suvajit Sengupta

Co-founder & CTO

Suvajit Sengupta | Co-founder & CTO

A passionate technologist who thrives at the intersection of customer needs and innovation. With a track record of building adaptive product teams, he share insights on solving real-world problems with AI and scalable tech solutions.

Interests: AI products, Team Leadership, Data Strategy

Content Overview

Share

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023