Future of Insurance: Speeding Up Operations with AI for Agencies

Suvajit Sengupta | 31st January, 2024

6 min reads

Suvajit Sengupta | 31st January, 2024 | 6 min reads

Artificial Intelligence is sweeping through the insurance industry and beyond, unleashing an exhilarating wave of innovation. This AI whirlwind is not an average evolution but an enthusiastic leap into the future of insurance.

However, the introduction of AI to the insurance industry triggers a multitude of questions and uncertainties concerning the efficiency and relevance of transformation. One intriguing question takes center stage - how can insurance agencies enhance their operational speed through AI integration?

AI holds the power to revolutionize insurance processing by speeding things up at every stage - data ingestion, insurance business process management, risk detection, and decision-making. The resulting time savings are substantial, opening up opportunities for insurance agents to connect with new customers.

Interested in a detailed exploration of how AI boosts the speed of insurance operations? Let's unravel the journey together.

The AI Revolution in Insurance

If you have been a part of the insurance industry for some time, you know its early reliance on manual processes involving extensive paperwork and face-to-face interactions. The first evolution began with the introduction of computers and digital tools. Later on, claim management software was added to the workforce.

Integrating big data and analytics into the industry revolutionized insurance claim management by enabling pattern recognition and predictive modeling, while RPA transformed routine tasks by automating them.

The most significant change came with the introduction of AI and machine learning, automating complex tasks like assessments, fraud detection, and customer interactions, processing claims faster, and improving customer satisfaction.

Including AI in the insurance claims process initiates a pivotal shift in the industry, pushing it towards enhanced efficiency and customer satisfaction. AI's capacity to expedite claim handling helps evolve the entire insurance business process management.

How AI Helps Insurance Agencies to Speed Up Operations

AI can seamlessly integrate with different processes in the insurance industry, enhancing efficiency at each stage. Let's explore the influence of artificial intelligence that boosts the operations in insurance agencies.

AI-Assisted Claims Processing

Looking back at the early days of insurance claims processing, it is evident that the workflow procedures of insurance agencies were immensely time-consuming and resource-driven. However, thanks to the AI effect, insurance claims processing becomes effortless and faster by automating tasks.

By implementing AI, insurance companies can quickly process an immense amount of data, identify patterns, and make informed decisions. The AI effect not only speeds up the claims process but also helps in detecting fraudulent activities more efficiently.

Video KYC

Video Know Your Customer (KYC) processes, powered by AI, transform how insurance agencies verify their clients' identities. The AI algorithms authenticate documents and confirm the identity of the individual.

This technology allows for the remote verification of identities in real time, reducing the time required for customer onboarding and compliance processes.

Facial Recognition Technology

Facial recognition technology is another AI application making strides in the insurance industry. It is used for identity verification in claims processing and underwriting.

By analyzing facial features, AI can quickly and accurately confirm the identity of claimants, reducing the risk of identity fraud. This technology also helps personalize customer experiences by recognizing returning customers and tailoring services to their needs.

AI-Powered Underwriting

AI-powered underwriting uses machine learning algorithms to analyze traditional and non-traditional data sources for risk assessment. It uses social media, IoT device data, and more data to view the risk involved comprehensively.

As a result, insurers can make more accurate predictions about risk, leading to better pricing models and more personalized insurance policies.

AI-Enhanced Customer Service

AI Chatbots and virtual assistants are capable of handling customer inquiries 24/7. They can provide instant responses and offer personalized advice based on the customer's history. This is an essential application for machine learning in insurance.

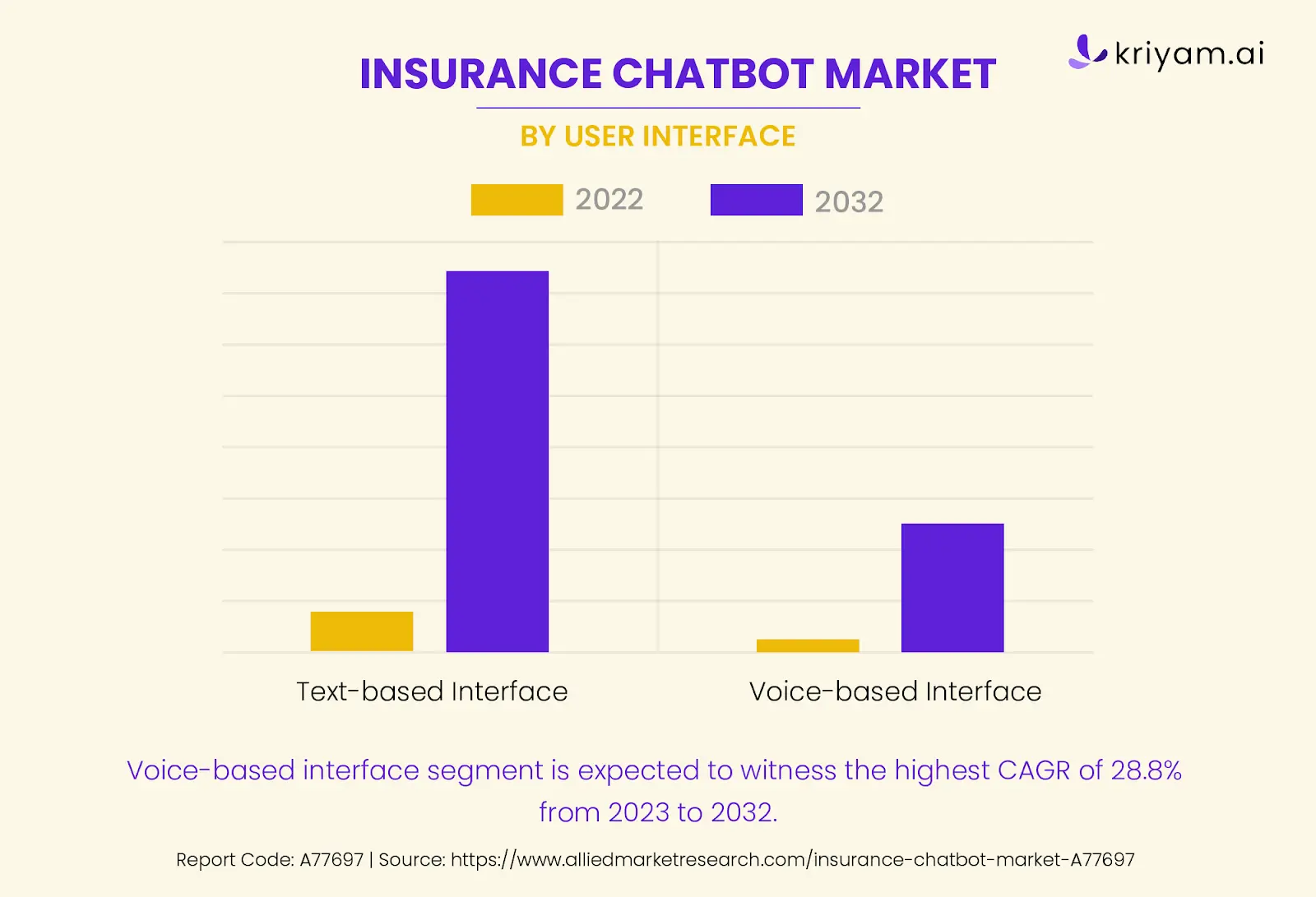

According to Allied Market Research, the global insurance chatbot market is projected to reach $4.5 billion by 2032. They estimated the future growth of insurance to be at a CAGR of 25.6% from 2023 to 2032.

AI chat services can efficiently assist with customer service, allowing human service representatives to focus on more complex tasks. The artificial intelligence integration in insurance also helps make more informed decisions, leading to a faster, more efficient, and more customer-friendly service.

Conversational AI, utilizing Natural Language Processing (NLP), offers real-time, 24/7 assistance in the insurance sector. This use case of conversational AI in insurance significantly enhances customer experience.

Benefits of Implementing Artificial Intelligence in Insurance Operations

- Enhanced Efficiency and Accuracy

The inclusion of AI spikes the efficiency of insurance operations by automating routine tasks, leading to faster processing times and reduced human error. For instance, let's consider AI’s effect on underwriting. AI algorithms can analyze and process claims or underwriting data more rapidly than traditional methods. This heightened efficiency allows insurers to handle a larger volume of transactions more accurately.

- Reduction in Operational Cost

When insurance agencies automate their processes, it helps reduce the workforce and time traditionally required for various tasks. This automation in insurance operations leads to a significant decrease in operational costs.

AI-driven predictive analytics takes it to the next level by helping in risk assessment and potentially lowering the cost associated with claims and fraud.

- Improved Customer Experience and Satisfaction

AI technologies transform customer support dynamics by incorporating chatbots and personalized recommendation systems. It enhances customer interaction by providing quick, accurate, and 24/7 support.

On top of that, AI-driven tools can offer customized insurance products tailored to individual customer needs, thus improving customer satisfaction and loyalty.

- Data-Driven Decision Making

AI's prowess in analyzing large volumes of data is remarkable as it offers valuable insights crucial for informed decision-making. Insurers can use these insights for better risk assessment, product development, and identifying market trends.

- Innovation and Competitive Advantage Integrating AI is the ultimate solution for insurance agencies aspiring to be at the forefront of innovation. It provides a competitive edge and empowers agents to shape enticing products and services.

In this era of evolving customer expectations, AI is the beacon guiding insurance agents toward creating modern solutions.

Tips for Insurance Agencies to Speed up With AI

Infusing AI into the insurance landscape is akin to planting seeds for a wise investment. The key to a prolific harvest lies in careful planning and strategic execution. Though it may feel like navigating uncharted terrain initially, rest assured, that AI seamlessly becomes part of the system within no time.

Are you wondering how to grow your insurance agency with AI? Let’s explore the tips to follow for seamless AI integration.

Identify Areas in Need of AI Solutions

- Understanding AI's Potential:

Before diving into AI, agencies must identify its applications in insurance operations where AI can have the most significant impact. Start by analyzing the current workflow procedures of the insurance agency and pinpoint inefficiencies or areas that would benefit from automation, enhanced accuracy, or data analysis.

- Conducting a Needs Assessment:

Agencies should conduct a comprehensive needs assessment to understand their specific requirements. So, agents should evaluate customer service, claims processing, fraud detection, and underwriting processes to see where AI can improve speed and efficiency.

Find and Integrate the Right AI Technologies

- Aligning AI with Operational Needs:

Select AI tools that align with your agency's specific operational needs. For instance, investing in AI chatbots may be beneficial if customer service is a priority. Similarly, AI solutions specializing in data analysis and pattern recognition would be more appropriate to streamline insurance claims processing.

- Vendor Evaluation and Selection:

Evaluating different AI technology providers in the insurance landscape is essential to find the best fit. Consider factors such as the provider's experience in the insurance sector, the scalability of their solutions, and the level of support they offer.

Develop a Strategic Plan

- Creating a Roadmap for AI Integration:

Develop a strategic plan for integrating AI into your operations. This plan should outline the goals, timelines, and steps for implementing AI solutions. It should also address how AI will fit into existing workflows and systems.

- Monitoring and Evaluation:

Establish key performance indicators (KPIs) to monitor the effectiveness of AI solutions. Reviewing these metrics will help assess AI's impact on operations and make necessary adjustments.

Train Staff and Align AI Adoption with Business Goals

Training is essential to ensure the insurance team can work with AI technologies. Staff should understand how to use these tools and how AI can enhance their roles and productivity.

Moreover, take the initiative to educate your team on KPIs relevant to AI solutions and actively involve them in the monitoring process. Encourage comprehensive feedback from the staff to facilitate productive adjustments in the AI integration.

Challenges and Considerations in Adopting AI

Addressing Data Quality and Integration Challenges

Ensuring high-quality data and integrating AI systems with existing infrastructure poses significant challenges. Data quality can lead to accurate AI outcomes, and integration issues can hinder the effective utilization of AI technologies.

Insurance companies should invest in robust data management systems to address these challenges. Regular audits and cleansing of data will enhance data quality. Additionally, adopting flexible AI solutions that can be easily integrated with existing systems will minimize integration issues.

The Importance of Skilled Professionals in AI Implementations

The lack of professionals skilled in AI technology can impede the successful implementation of AI in insurance operations. Without proper skills, staff are inefficient in using AI tools productively.

Insurance agencies should focus on training existing staff on AI capabilities and applications. Hiring AI specialists or partnering with AI solution providers can also bridge the skill gap. Continuous learning and development programs can ensure the workforce stays updated with AI advancements.

Balancing AI and Human Elements in Customer Service

AI can indeed enhance efficiency in customer service. However, over-reliance on AI could affect customer relationships and satisfaction. The focus should be on how to grow your insurance agency with AI rather than entirely switching to AI.

To strike the right balance, insurance agencies should implement AI tools for handling routine inquiries and tasks. At the same time, complex and sensitive issues should be assigned to the insurance agents. Regular feedback from customers can also guide the optimization of this balance.

Conclusion

A wealth of benefits await insurance agencies as they embark on this AI journey, spanning every stage of insurance processing, from data collection to swift decision-making. All that's required is a grasp of AI fundamentals and a strategic approach, paving the way for agents to relish the best results.

The AI landscape in insurance is booming, assisting in a new era of efficiency and precision. It's high time for agencies to ride the AI wave, find their perfect AI match, and unlock the bright future of insurance.

Brace yourselves for the AI revolution in the insurance industry- Kriyam.ai is the ideal partner to transform the game for insurance agents, integrating every crucial feature with innovation.

Key Features of Kriyam. ai

- Report Automation

- Instance report generation

- Data encryption and secure storage

- Route Mapping for safe navigation

- Compliance with data protection regulations

- Scalability of automation

How Kriyam helps insurance agencies to speed up:

- Reduces Turn Around Time (TAT) by 25%

- Amplifies Productivity by 3 Times

- Diminishes Rejections by 80%

- Saves 12 hours per agent per week

About the author

Suvajit Sengupta

Co-founder & CTO

Suvajit Sengupta | Co-founder & CTO

A passionate technologist who thrives at the intersection of customer needs and innovation. With a track record of building adaptive product teams, he share insights on solving real-world problems with AI and scalable tech solutions.

Interests: AI products, Team Leadership, Data Strategy

Content Overview

Share

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023