Revolutionizing Insurance Claims: The Power of Automation in Insurance

Suvajit Sengupta | 3rd January, 2024

3 min reads

Suvajit Sengupta | 3rd January, 2024 | 3 min reads

Introduction

Picture this: You're at the helm of an insurance agency, navigating through the intricate maze of claim processing.

It's a world where every second counts and every decision impacts your bottom line and customer satisfaction. Now, imagine transforming this landscape, not incrementally, but radically.

Welcome to the era of automation in insurance claim processing – a game-changer that's reshaping how we think about efficiency and innovation in the sector.

According to Deloitte's 2024 insurance outlook, the industry is at a pivotal moment, with insurers evolving to address a changing operating environment and aiming for a greater societal impact.

The question is no longer if automation is necessary but how swiftly it can be integrated into your operations.

You're not just managing claims; you're orchestrating a symphony of efficiency, accuracy, and customer satisfaction. Automation is your conductor's baton, leading the way to a future where streamlined processes are the norm, not the exception.

In this blog, we'll dive into the transformative power of automation in insurance claim processing, exploring its myriad benefits and how it's setting new benchmarks in the industry.

Let's dive right in!

The Urgent Need for Automation in Insurance Claims

Let's face it: the traditional way of handling insurance claims is like trying to navigate through a maze blindfolded. It's slow, it's cumbersome, and frankly, it's outdated.

But what exactly makes manual claim processing such a headache? Let's break it down:

Time-Consuming Processes: Think about the endless paperwork, the back-and-forth communication, and the manual data entry. It's like running a marathon with a heavy backpack.

Error-Prone: With humans at the helm, mistakes are inevitable. A misplaced digit here, a missed signature there – it's a recipe for inaccuracies.

High Operational Costs: More hands on deck means higher costs. It's like pouring money into a bottomless pit.

Delayed Response Times: In a world where instant gratification is the norm, waiting weeks for a claim resolution is like watching paint dry.

Customer Dissatisfaction: This one's a no-brainer. Delays and errors lead to unhappy customers, and unhappy customers are bad for business.

Now, think about the ripple effect of these inefficiencies. For insurers, it's not just about the extra hours and dollars spent; it's about the strain on resources and the impact on their reputation.

Demand for Speed and Accuracy

But wait, there's more. Customers today aren't just looking for any claim resolution; they want it fast, and they want it right.

Here's why speed and accuracy are non-negotiable in the world of insurance claims:

Instant Solutions: We live in a world of instant coffee, instant streaming, and instant messages. Why should insurance claims be any different? Customers expect quick resolutions, and they expect them now.

Accuracy is Key: A single error can turn a straightforward claim into a complicated mess. Accuracy is not just important; it's essential.

Building Trust: When insurers deliver on their promise of speed and accuracy, they build trust. Trust, as we all know, is the cornerstone of any successful business.

Staying Ahead of the Competition: In a sea of insurance providers, the ones who can offer swift and accurate claim resolutions are the ones who stand out. It's not just a service; it's a competitive edge.

So, what's the bottom line? The demand for speed and accuracy in insurance claims isn't just a passing trend; it's the new standard.

And what is the only way for insurers to meet this standard? You guessed it – automation. It's not just about keeping up; it's about staying ahead, about revolutionizing the way we think about insurance claims.

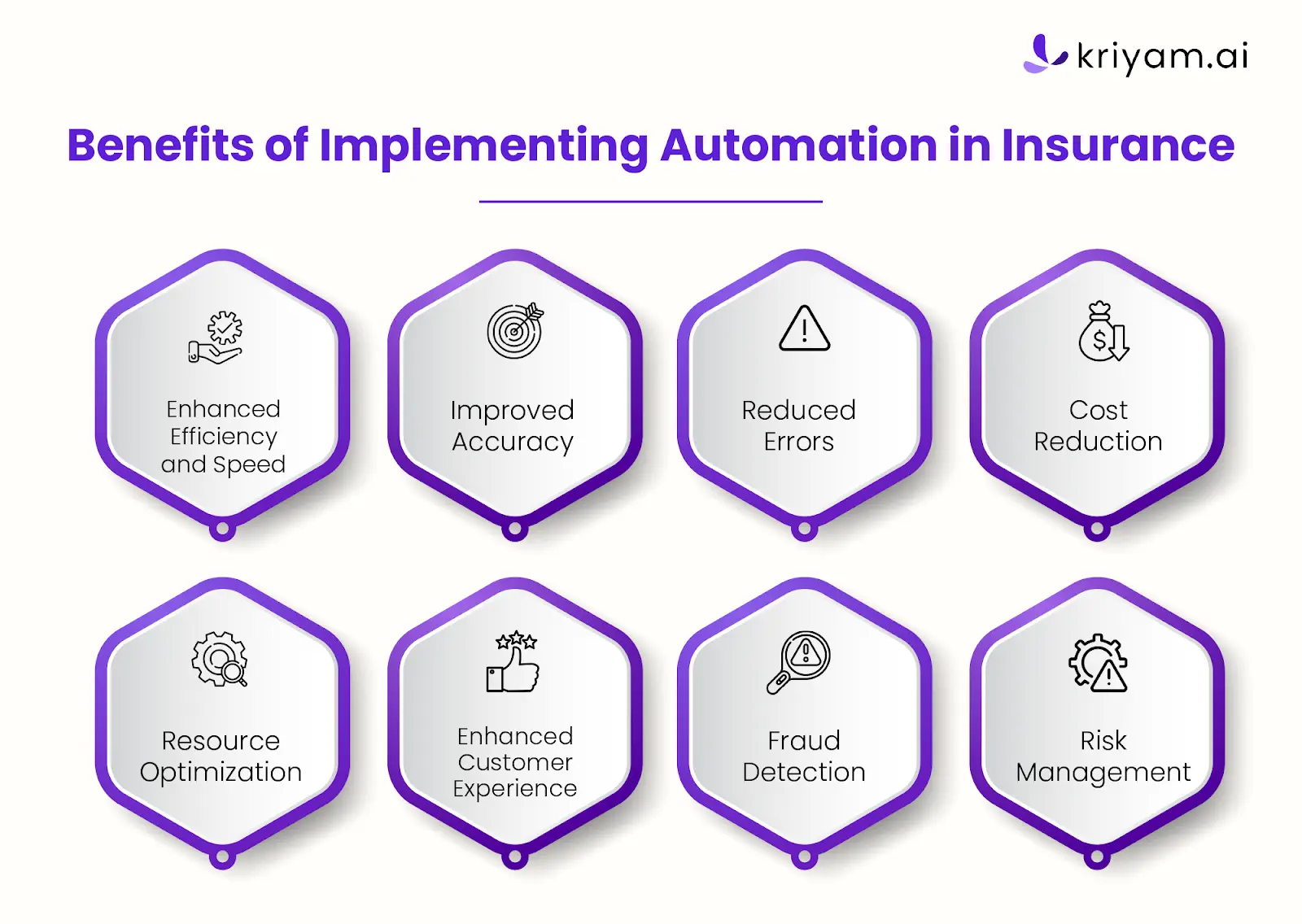

Key Benefits of Implementing Insurance Automation

Enhanced Efficiency and Speed

Imagine a world where insurance claims are processed at the speed of light. Okay, maybe not that fast, but you get the picture.

Automation in insurance claims is like putting your claim processing on turbo mode. Here's how it revs up the engine:

Streamlined Workflows: Automation turns a tangled web of tasks into a smooth, straight line. It's like having a superhighway where there used to be bumpy roads.

Reduced Processing Times: With automation, claims that took days or weeks can now be processed in hours or even minutes. It's like switching from a bicycle to a sports car.

Case Study Spotlight: Take Company X, for example. They implemented automation and saw their claim processing time drop by a staggering 70%. That's not just improvement; that's transformation.

Improved Accuracy and Reduced Errors

Now, let's talk about precision. Automation in insurance claims is like having a sharpshooter on your team.

Here's why accuracy is the name of the game:

Minimized Human Errors: Let's face it, we're only human. But automation? It doesn't forget, it doesn't get tired, and it doesn't make typos.

Consistent Accuracy: Every claim is processed with the same level of precision every single time. It's like having a fail-safe built into your system.

Cost Reduction and Resource Optimization

Who doesn't like saving money? With insurance business process automation, you're not just streamlining processes; you're also tightening the purse strings.

Here's the deal:

Lower Operational Costs: Automation means fewer manual tasks, which translates to lower labor costs. It's like getting the same (or better) results for less.

Optimized Resource Allocation: With automation handling the grunt work, your team can focus on more strategic tasks. It's about working smarter, not harder.

Enhanced Customer Experience

Happy customers are the lifeblood of any business, and automation is the secret sauce to customer satisfaction in the insurance world.

Here's how:

Faster Claim Resolutions: Customers get their claims processed swiftly, which means less waiting and more smiling.

Personalized Interactions: Automation allows for more tailored customer experiences. It's like knowing what your customer wants before they even ask.

Fraud Detection and Risk Management

Last but not least, let's talk about keeping the bad guys at bay. Automation is like having a detective on your team, always on the lookout for foul play.

Here's the scoop:

Advanced Fraud Detection: Automated systems can analyze patterns and flag suspicious activities that might go unnoticed by human eyes.

Risk Mitigation: By identifying potential risks early, automation helps in mitigating them before they escalate. It's like having a crystal ball that actually works.

Automation in insurance claims isn't just a fancy add-on; it's a game-changer. It's about doing things faster, with more accuracy, and at a lower cost while keeping customers happy and fraudsters in check.

It's not just the future; it's the present, and it's revolutionizing the insurance landscape one claim at a time.

Trends and Innovations in Automated Claim Processing

Latest Technological Trends

Hey there, let's dive into the techy side of things. You know, the cool innovations that are making waves in the world of insurance claims.

It's like peeking into a crystal ball to see the future of automation. Here's what's hot right now:

Artificial Intelligence (AI): AI is the brainy whiz kid of automation. It's not just about processing claims; it's about smart processing. AI algorithms can analyze patterns, predict outcomes, and make decisions. It's like having a super-smart assistant who never sleeps.

Machine Learning: This is AI's sidekick. Machine learning algorithms learn from past data to improve future performance. Think of it as a self-updating system that gets better with every claim.

Predictive Analytics: This technology is like a fortune teller for insurance claims. It uses data to predict trends and outcomes, helping insurers to be proactive rather than reactive.

Future Trends: So, what's next? We're looking at even more personalized claim processing, real-time decision-making, and perhaps even AI-powered chatbots that handle claims from start to finish. The possibilities are endless.

Adapting to the Digital Age

Now, let's talk about the big shift – the digital revolution in insurance claims. It's like moving from an old-school flip phone to the latest smartphone. Here's how the industry is keeping up:

Embracing Digital Solutions: Insurance companies are swapping out their old ways for sleek, digital processes. It's all about being faster, smarter, and more connected.

Customer-Centric Platforms: The focus is now on platforms that cater to the customer's every need. It's like building a digital bridge between insurers and policyholders.

Adapting to Change: Companies are not just adopting new technologies; they're adapting their entire mindset. It's about being agile and responsive in a fast-changing digital world.

Real-Life Examples: Company Z, for instance, transformed its claim processing by going digital, resulting in a 50% increase in customer satisfaction. It's proof that when you embrace the digital age, good things happen.

In conclusion, the trends and innovations in automated claim processing are not just shaping the present; they're paving the way for a more efficient, more customer-friendly future.

Overcoming Challenges in Implementing Automation

Identifying Common Obstacles

Let's be honest: adopting automation isn't always a walk in the park. There are bumps along the road. Understanding these challenges is the first step to overcoming them. So, what are these hurdles?

Resistance to Change: It's human nature to resist change, especially when it shakes up familiar routines. Employees might be skeptical or even fearful about being replaced by machines.

Integration Issues: Fitting new technology into existing systems can be like trying to solve a complex puzzle. It's not always a seamless fit.

Data Privacy Concerns: With great data comes great responsibility. Ensuring the security and privacy of customer data is a big concern.

Skill Gaps: Not everyone is a tech whiz. The lack of technical know-how can be a significant barrier. Cost Concerns: Let's face it: implementing new technology can be expensive. Budget constraints can be a real challenge.

Strategies for Effective Implementation

Now, let's talk solutions. How do you navigate these challenges and make the transition to automation as smooth as possible?

Embrace Change Management:

Communicate: Keep everyone in the loop. Explain the why, the how, and the what of automation.

Train and Empower: Offer training sessions. Turn your employees into champions of change.

Seamless Integration:

Choose Wisely: Pick solutions that integrate well with your existing systems.

Test and Iterate: Start with a pilot program. Test, learn, and then scale.

Safeguard Data:

Prioritize Security: Choose platforms known for their robust security measures.

Stay Compliant: Keep abreast of data protection laws and regulations.

Bridge the Skill Gap:

Hire Experts: Sometimes, bringing in fresh talent with the necessary skills is the way to go.

Upskill Existing Staff: Invest in training your current workforce.

Budget Smartly:

Cost-Benefit Analysis: Weigh the long-term benefits against the initial costs.

Explore Funding Options: Look for grants, loans, or partnerships to ease financial burdens.

Related Read - Automation in Banking and Insurance - Transforming BFSI

Conclusion

In summary, the journey through the world of automation in insurance claims reveals a landscape ripe for revolution.

From the cumbersome inefficiencies of traditional methods to the sleek, streamlined processes enabled by AI in insurance industry and machine learning, automation stands as a beacon of efficiency, accuracy, and cost-effectiveness.

The path is clear: embracing insurance automation software is no longer an option but a necessity for those seeking to thrive in the insurance industry. It's time to step into a future where claims processing is not just faster and more reliable but also more attuned to the needs of the modern customer.

So, let's take action, harness the power of automation, and transform the way we handle insurance claims, making our businesses more efficient, our customers happier, and our futures brighter.

About the author

Suvajit Sengupta

Co-founder & CTO

Suvajit Sengupta | Co-founder & CTO

A passionate technologist who thrives at the intersection of customer needs and innovation. With a track record of building adaptive product teams, he share insights on solving real-world problems with AI and scalable tech solutions.

Interests: AI products, Team Leadership, Data Strategy

Content Overview

Share

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023