The Transformative Impact of AI in Insurance Industry

Suvajit Sengupta | 21st December, 2023

5 min reads

Suvajit Sengupta | 21st December, 2023 | 5 min reads

Introduction

You've probably heard the buzz about AI transforming industries left and right, but what does this mean for you in the insurance world?

Think about it: every day, you're navigating a sea of policies, claims, and customer interactions. Now, imagine if these tasks were not just easier but smarter and more efficient. That's where AI steps in.

But wait, there's more. AI in insurance isn't just a tech trend; it's a game-changer in how we approach insurance processes. From personalized policy recommendations to lightning-fast claims processing, AI is reshaping the landscape. And here's the kicker: it's not about replacing the human touch; it's about enhancing it.

So, what can you expect from this AI revolution as an insurance professional? Let's dive in and explore how AI is not just streamlining insurance processes but also opening doors to new possibilities and efficiencies.

Ready to see how? Let's get started!

The Emergence of AI in Insurance

Let's take a little trip down memory lane, shall we? The insurance industry, believe it or not, has always been a bit of a tech enthusiast.

From the early days of handwritten policies to the adoption of computers, it's been quite the journey. But here's where it gets interesting: the leap into the world of Artificial Intelligence (AI).

Now, you might be wondering, why AI and why now? Well, it's simple. The insurance sector is swimming in data – from customer profiles to claim histories. And who's better at handling heaps of data than AI? Exactly, no one!

Efficiency is Key: AI is like that super-efficient colleague we all wish we had. It processes claims and evaluates risks at lightning speed.

Accuracy Matters: With AI, the guesswork in risk assessment is taking a back seat. We're talking about precision like never before.

Customer Service Revolution: AI isn't just about crunching numbers; it's transforming how we interact with customers. Chatbots, personalized policies – you name it, AI is on it.

So, what sparked this shift towards AI? It's a mix of necessity and opportunity. The pressure to stay competitive and provide top-notch service is higher than ever. And let's face it, AI offers solutions that we could only dream of a decade ago.

In a nutshell, AI in insurance isn't just a fleeting trend; it's the new frontier.

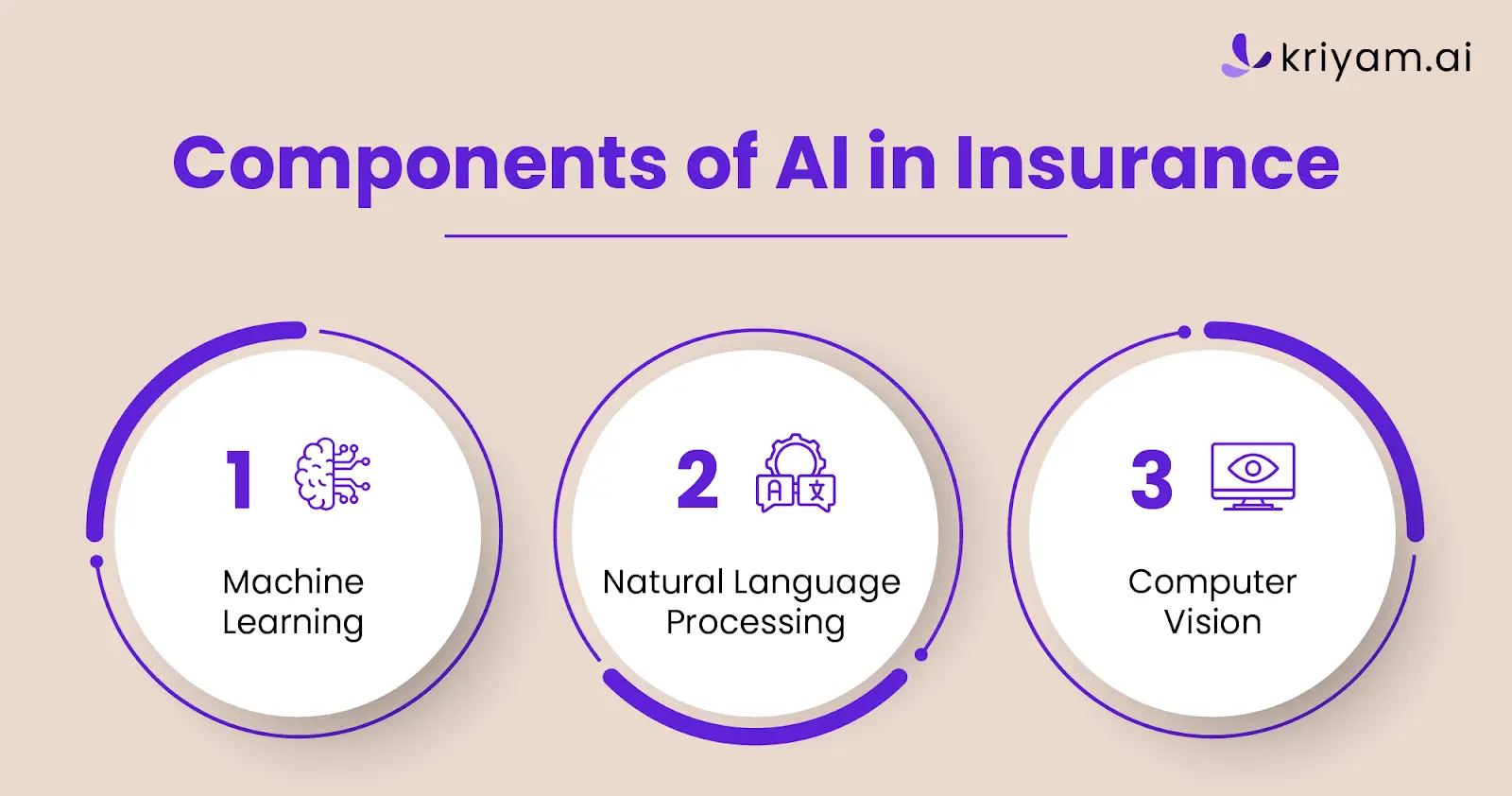

Core Components of AI in Insurance

Think of AI as a toolbox, each tool crafted to tackle specific tasks. In the insurance world, three major tools – Machine Learning (ML), Natural Language Processing (NLP), and Computer Vision – are making some serious waves.

Let's break these down:

Risk Assessment: Imagine having a crystal ball that could predict risks. That's ML for you. It sifts through mountains of data – from driving records to health stats – to pinpoint potential risks. This isn't just guesswork; it's data-driven precision.

Policy Customization: One size fits all? Not anymore. ML tailors policies to fit each customer like a glove. By analyzing past interactions and preferences, it offers personalized insurance solutions. The result? Happier customers and policies that really fit their needs.

2. Natural Language Processing (NLP)

Chatbots and Virtual Assistants: Have you ever chatted with a customer service bot? That's NLP in action. These bots are getting smarter, understanding, and responding to customer queries in real time. No more waiting on hold for hours!

Enhancing Customer Experience: NLP isn't just about answering questions; it's about understanding customer needs. It analyzes customer feedback, helping insurers fine-tune their services. The goal? To make every interaction as smooth and helpful as possible.

3. Computer Vision

Streamlining Claims Processing: Picture this: you upload a photo of a car accident, and voilà, your claim is processed. Computer Vision makes this possible. It analyzes images and videos to assess damage, speeding up the claims process like never before.

Accuracy and Fraud Detection: It's not just about speed; it's also about accuracy. Computer Vision helps identify discrepancies in claims, flagging potential fraud. This means a more trustworthy process for everyone involved.

So, what's the big deal? Each of these components is transforming insurance from a slow, paper-based dinosaur into a fast, efficient, and customer-friendly industry. And the best part? This is just the beginning. The potential of AI in insurance is as vast as the data it processes.

Transformative Applications of AI in Insurance

Now, let's get to the really exciting part – how AI is revolutionizing the insurance industry. It's like watching a sci-fi movie, but it's real, and it's happening right now in your world!

Risk Assessment

Data, Data Everywhere: AI loves data. It munches on various data sources – social media, IoT devices, past claims – you name it. The goal? To understand risks like never before.

Smarter Profiling: Gone are the days of generic risk assessments. AI creates detailed risk profiles, making underwriting as precise as a surgeon's scalpel. This means fairer premiums for customers and fewer surprises for insurers.

Claims Processing

Speed is the Name of the Game: Remember the old days of waiting weeks for a claim to process? AI's changing that. It automates the nitty-gritty, slashing processing times from weeks to mere hours or even minutes.

Accuracy and Customer Satisfaction: Faster doesn't mean sloppier. AI ensures claims are processed accurately, reducing errors and boosting customer satisfaction. Happy customers, happy life, right?

Related read - Automation in BFSI Sector

Customer Support

Always There, Always Ready: AI-powered chatbots and virtual assistants are like the superheroes of customer service. They're available 24/7, answering questions, guiding policyholders, and providing instant support.

Understanding Customers Better: These AI tools are constantly learning from interactions, meaning they get better and more helpful over time. It's like having a customer service rep who never sleeps and always learns.

Personalized Policies

Tailor-Made Just for You: AI is the master tailor of insurance policies. By analyzing individual customer data, it crafts policies that fit each person's unique needs and lifestyle. It's personalization at its best.

Dynamic Adjustments: As life changes, so do insurance needs. AI adapts policies over time, ensuring they always provide the right coverage. It's like having a policy that grows with you.

Fraud Detection

The Fraud Detective: AI is on the lookout for fraud. It analyzes patterns and flags unusual activities, helping to nip insurance fraud in the bud.

Saving Money and Trust: By catching fraud early, AI saves insurers (and ultimately policyholders) big bucks. Plus, it maintains trust in the system – a win-win for everyone.

In a nutshell, AI is not just a tool; it's a game-changer in the insurance industry. It's making insurance faster, smarter, and more personalized. And guess what? This is just the beginning.

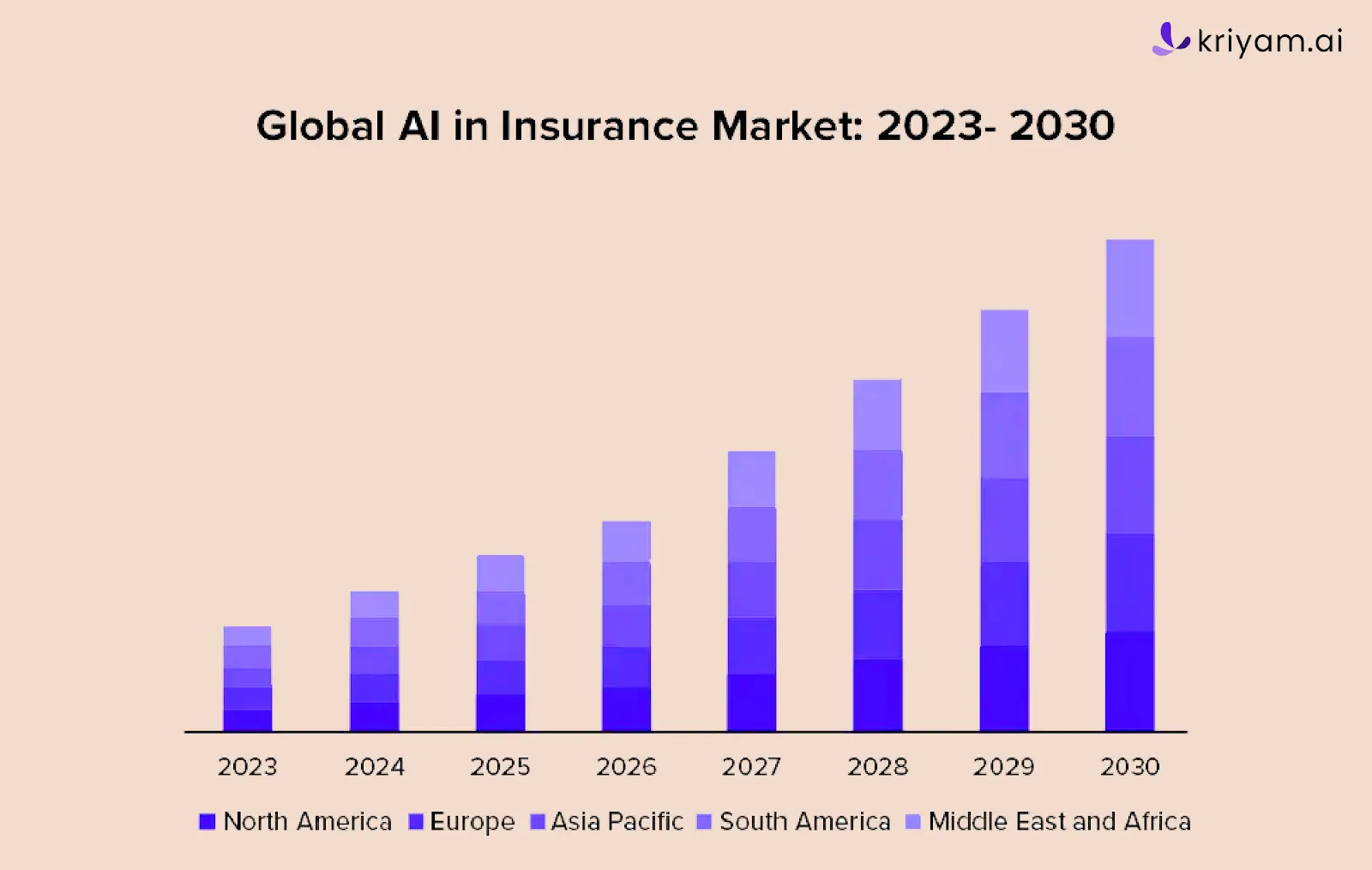

The Future of AI in Insurance

Predictive Analytics

Seeing into the Future: Predictive analytics is like having a crystal ball. By analyzing patterns and trends from heaps of data, AI can predict future claims and customer behavior. What does this mean? More informed decisions and proactive strategies.

Customization and Prevention: Imagine being able to offer policies that not only cover risks but also help prevent them. Predictive analytics can identify potential issues before they occur, leading to safer choices and fewer claims.

Upcoming AI Technologies

Blockchain Bonanza: Blockchain and AI are joining forces. This combo promises enhanced security and transparency in transactions. Think smart contracts that execute themselves when conditions are met. It's a whole new level of trust and efficiency.

Telematics Takes Center Stage: Telematics isn't just for tracking your pizza delivery anymore. In insurance, it's transforming how we assess risk. By monitoring real-time data from vehicles, insurers can offer personalized rates and safer driving incentives.

Future Trends and Advancements

AI Ethics and Regulation: As AI becomes more integral, expect a surge in discussions about ethics and regulations. How do we keep AI fair and unbiased? It's a hot topic that's going to shape the future of AI in insurance.

Integration with IoT: The Internet of Things (IoT) and AI are a match made in tech heaven. From smart homes to wearable health devices, the integration of these technologies will offer unprecedented insights into risk assessment and management.

So, what's the bottom line? The future of AI in insurance is not just about technology; it's about how we use that technology to create smarter, safer, and more personalized insurance experiences.

And the best part? We're just getting started. The potential is limitless, and the journey is as thrilling as it gets.

Try kriyam.ai - the best AI-powered software for the insurance sector!

Overcoming Challenges and Ethical Considerations

Now, let's talk about a crucial aspect that often flies under the radar when we're all hyped up about AI in insurance – the challenges and ethical considerations. Yes, AI is cool, but it's not without its hurdles. So, let's unpack these.

Addressing Data Privacy and Security Concerns

The Privacy Puzzle: In a world where data is king, protecting customer information is paramount. With AI devouring data to function, how do we ensure this data is safe and private? It's a tightrope walk between leveraging data and respecting privacy.

Fortifying Security: Cybersecurity isn't just a buzzword; it's a necessity. As insurers harness AI, they also need to beef up their security game. Breaches are not just a headache; they're a trust-destroyer.

Ethical Implications of AI Decisions in Insurance

Bias in AI: Here's a hard truth – AI can be biased because it learns from data created by humans, who, let's face it, are sometimes biased. This can lead to unfair policy rates or claim denials. The big question is, how do we keep AI fair and unbiased?

Transparency in AI Decisions: When AI decides who gets insured and who doesn't or whose claims get approved, transparency becomes key. Customers have the right to know how these decisions are made. It's about keeping AI accountable.

So, what's the takeaway here? While AI is transforming the insurance industry in fantastic ways, it's also essential to navigate these challenges with care.

It's about finding that sweet spot where innovation meets responsibility. After all, the goal is to use AI not just to make insurance smarter but also safer and more equitable for everyone.

Conclusion

As we wrap up this journey through the transformative world of AI in the insurance industry, it's clear that we're standing on the brink of a major shift.

AI's role in risk assessment, claims processing, customer support, policy personalization, and fraud detection is not just an upgrade – it's a revolution.

The future, with predictive analytics, blockchain, and telematics, is brimming with possibilities that promise to make insurance smarter, more efficient, and incredibly user-centric.

But remember, with great power comes great responsibility. Navigating the challenges of data privacy, security, and ethical AI use is crucial. As we embrace these advancements, it's vital to do so with a balanced approach, ensuring that innovation benefits everyone involved.

Kriyam.ai stands ready to be your guide and partner for those of you in the insurance sector looking to harness the power of AI.

Explore the possibilities with us and step into a future where AI doesn't just streamline insurance processes – it redefines them. The future of insurance is here, and it's powered by AI. Let's embrace it together!

About the author

Suvajit Sengupta

Co-founder & CTO

Suvajit Sengupta | Co-founder & CTO

A passionate technologist who thrives at the intersection of customer needs and innovation. With a track record of building adaptive product teams, he share insights on solving real-world problems with AI and scalable tech solutions.

Interests: AI products, Team Leadership, Data Strategy

Content Overview

Share

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023