Insurance

AI-Driven Field Verification Software for Claim Handling in 2024

If you belong to the banking, financial services, and insurance (BFSI) world, you know how lengthy and complicated the claims processing task is. Adding to the complexity, processing the claims with utmost efficiency and unerring accuracy is paramount.

Accuracy and efficiency in process claims are not just operational targets- they are the critical factors that dictate customer loyalty and overall business success.

On top of that, the increasing competition and evolving customer expectations exert constant pressure on BFSI institutions to enhance their service quality.

In this framework, field verification software emerges with a groundbreaking solution- AI claim processing. This trailblazing solution transforms the historically tedious and error-prone claims processing task into a model of efficiency and precision.

What is Field Verification Software?

Field verification software is an innovative technology designed to revolutionize claims handling. It leverages cutting-edge technologies like Optical Character Recognition (OCR), Artificial Intelligence (AI), and Machine Learning (ML).

Harnessing the power of these technologies, the AI-driven insurance claims management software automates the processing of claim-related documents.

The field verification software can extract, analyze, and validate data from various documents, such as medical bills, repair invoices, and insurance claim forms.

But the question that needs an answer is whether adopting the field verification software is really worth it. This automated process is unquestionably beneficial for BFSI as it reduces human error, which is a common error that delays claims processing. It also expedites claim resolution and enhances data security, unlike manual processing.

According to an analysis from Precedence Research, AI will reduce the operational costs in the insurance industries by 40% in 2030. AI can also increase productivity by streamlining the traditional process, which is both time-consuming and resource-intensive.

How Does Automated Claim Processing Work?

Automated claim processing is a multi-stage process transforming how BFSI institutions handle claims. Agencies are at a crossroads here- they can adopt the entire automated process or selectively incorporate the workflow stages into their operations.

Moving forward, let's unravel the step-by-step journey through AI claims processing.

1. Document Ingestion:

The process begins when a policyholder reports an insurance claim through a dedicated app or online portal. They have to furnish claim information like the place and date of the event, documents, and necessary images. Consumers have the flexibility to scan physical documents or upload digital files. The portal accommodates various formats like PDFs, emails, and scanned images.

2. Data Extraction and Understanding:

The insurance claims management software utilizes advanced technologies like AI and OCR to analyze documents comprehensively. It extracts crucial data points such as policy numbers, claimant details, and cost information.

3. Validation:

Validation is crucial in insurance data processing as it guarantees accuracy and adherence to regulatory standards. After extracting the data, the software thoroughly validates it, cross-referencing it against pre-established rules and databases.

4. Decision Making: The insurance claims management software can automatically approve claims based on specific criteria. However, if the claim is a little complex for the system, it is flagged for manual review.

5. Payout:

Once the decision-making is complete, the process moves to its concluding phase - Processing Payouts. The approved claims are integrated into payment systems for prompt processing. Subsequently, the claimant is notified of the decision, enhancing transparency and trust.

How Field Verification Software is Transforming Claims Processing

Field verification software is revolutionizing the claims processing landscape within the BFSI sector by significantly enhancing efficiency and accuracy.

It doesn't merely introduce incremental enhancements- the advanced claims technologies elevate claims processing to diverse altitudes of excellence. For instance, the software not only diminishes manual errors but also helps streamline work and eradicates fraudulent claims.

Key Features of Field Verification Software

Several key factors contribute to this reimagined AI claims solutions.

Streamlining Document Handling:

The most immense burden of traditional claims processing is the need to handle a multitude of documents manually. However, the field verification software takes off this burden by digitizing and automating the handling of records. It substantially reduces the time and labor involved in manual sorting, filing, and data entry.

Enhanced Data Extraction with AI and OCR:

With AI-powered Optical Character Recognition (OCR) technology, the software can accurately read and extract data, even from complex or unstructured documents. Since the technology can accurately capture information, it eliminates the likelihood of human errors in manual data entry.

Swift and Accurate Data Validation:

The software has access to pre-existing databases and regulatory standards. Therefore, it performs real-time validation of the information unparallel to manual verification. Moreover, it remarkably wipes out processing errors and incorrect claim handling.

Fraud Detection and Risk Management:

Within the BFSI sector, fraud detection and risk management are two strong pillars with paramount significance. So, the software comes with sophisticated algorithms to detect anomalies that indicate fraudulent activities. It is efficient to prevent financial losses due to fraudulent claims.

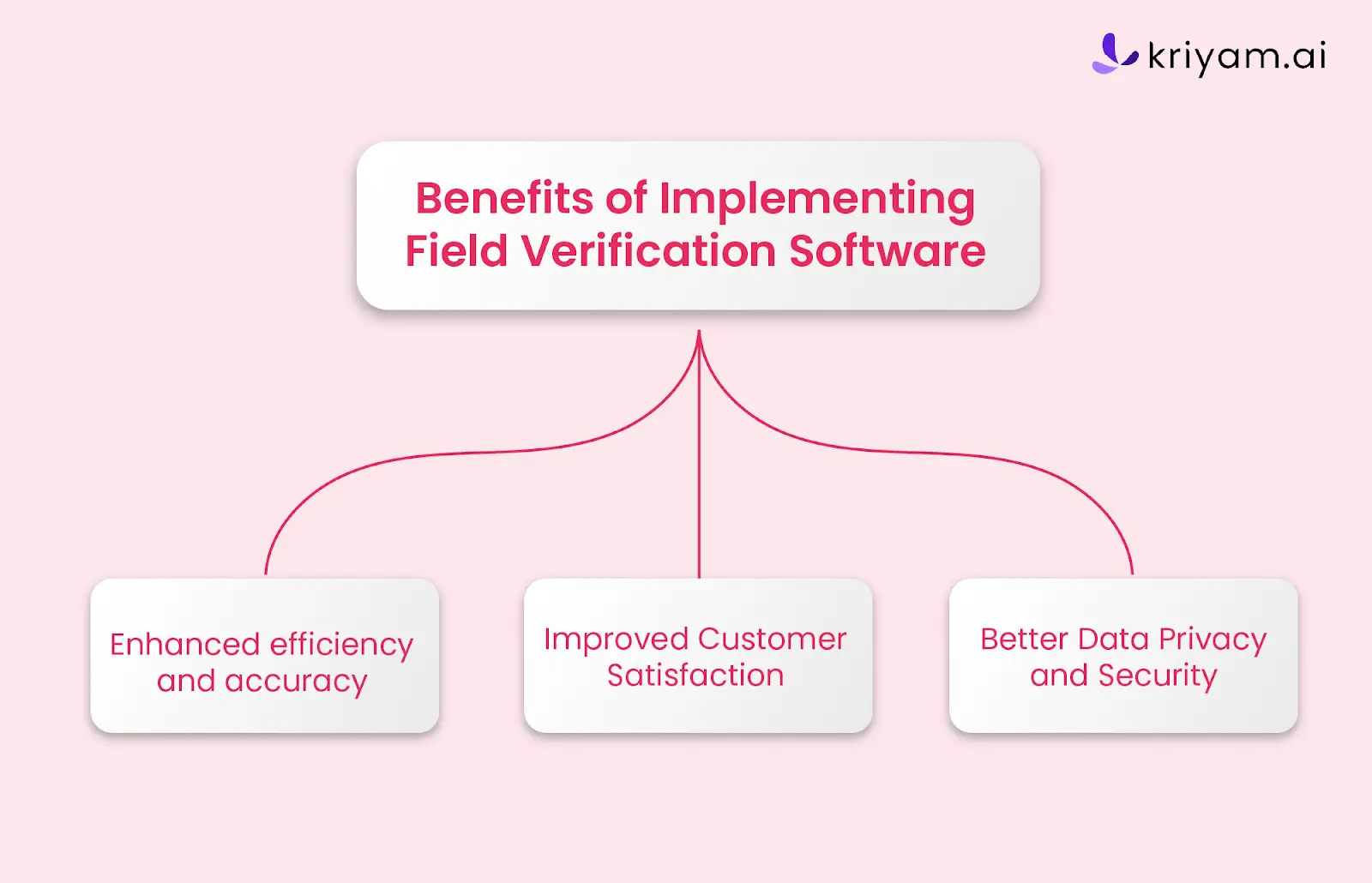

Benefits of Implementing Field Verification Software

Now that we have navigated the intricacies of the automated claims processing software, its benefits are already understood. Let's jot down the perks of incorporating the software into any claims processing system.

Increased Efficiency:

The streamlined process leads to a significant reduction in claim processing times, enhancing overall operational efficiency.

Enhanced Accuracy:

Automation minimizes human error, leading to more accurate claim processing and data management.

Improved Customer Satisfaction:

Quicker claim resolutions directly translate to higher customer satisfaction and loyalty.

Cost Reduction:

Automation substantially reduces operational costs, particularly those associated with manual processing and error rectification.

Better Data Privacy and Security:

The software employs supreme security measures that protect the sensitive data of the policyholders. Moreover, it never fails to ensure that the process complies with data protection laws.

Scalability:

As time unfolds, BFSI agencies experience an influx of clients, prompting them to search for a solution tailored to accommodate their expanding needs. An automated system takes away this growing concern as it easily handles the increasing claim volumes.

Challenges in Implementing A Field Verification Software

While field verification software offers numerous advantages, its implementation can also present several challenges. When BFSI institutions address these challenges, they fully leverage the benefits of this technology.

Technical Integration and Compatibility:

When you go for a new software, integrating it with existing IT infrastructure can be complex and time-consuming. It is complex because many BFSI institutions don't have legacy systems readily compatible with modern field verification softwares.

Data Migration and System Interoperability:

Transferring existing data into the new system and ensuring interoperability between software applications can pose technical hurdles.

Staff Training and Adaptation:

To harness the best results from the software, the staff needs to learn new skills. The transition to automated processes can be challenging for employees accustomed to traditional methods. It is important to educate the employees about the necessity of integrating the software into the system before training them.

Regulatory Compliance:

As you might be already aware, the BFSI sector is heavily regulated. Any new technology in the industry must comply with existing laws and regulations. Ensuring the software meets all regulatory requirements is crucial to avoid legal and financial penalties.

Kriyam.ai- Redefine Your Insurance Field Investigation

Kriyam.ai is an AI-powered field verification tool that can reform your insurance investigation experience with security, transparency, and real-time updates. When you embrace the excellence of kriyam.ai, your investigation process gets a boost with unparalleled efficiency and pinpoint accuracy.

Impact of Kriyam.ai on Field Investigation:

- Reduces Turn Around Time (TAT) by 25%

- Spikes Productivity by three times

- Shrinks the Rejection rate by 80%

- Minimizes the effort per person by 12 hours every week

- Streamline your workflow by leveraging automation for report creation, allowing for a more focused allocation of resources for core responsibilities with Kriyam.ai.

What Kriyam.ai Delivers

- Custom Report Generation

- Real-time Tracking

- Automated Case Summary

- Seamless operation in low networks

- Data Encryption and Secure Storage

- Route Mapping to guide agents

- Geo-tagging Cases

Ready to make the leap? Join Kriyam.ai for free!

Conclusion

Within the realm of claim processing, accuracy and efficiency emerge as paramount elements, reaching their zenith through automated field verification tools. Therefore, integrating this AI claim processing software has become a strategic necessity for BFSI institutions seeking to maintain a competitive edge.

As this technology continues to develop, it brings even more efficiency, accuracy, and customer satisfaction advancements in the future. For instance, predictive analysis, augmented reality, voice recognition, and blockchain technology are just some developments we can look forward to in field verification tools.

Undoubtedly, a field verification tool like kriyam.ai is a profitable investment for BFSI institutions. If you are yet to jump on board with this tool, your competitors might be pulling ahead in the race.

Seize the opportunity to make a game-changing decision to join kriyam.ai and attain enhanced efficiency and pinpoint accuracy.

Suvajit S

26th January, 2024

Latest

LATEST BLOGS

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023

FEATURED

Automation

Top 5 Best Field Service Management Software in 2025

Best Field Service Management Software

Shreyas R

27th November, 2023